Overview

Select Energy Services (NYSE: WTTR) filed an S-1/A with the Securities and Exchange Commission and is expected to IPO this Friday, April 21, 2017. The company is offering 10.6 million shares of its common stock at a marketed price range of $15 to $18. It also has an additional 1.59 million shares as an overallotment option for its underwriters. The company expects to raise $175M through the offering of its shares.

Assuming the stock prices at the mid-point of its price range, it would have a market cap value of $1.14B and trade at a 3.78x price/sales ratio.

The underwriters are Credit Suisse, FBR, Wells Fargo Securities, BofA Merrill Lynch, Citigroup, J.P. Morgan, Deutsche Bank Securities, RBC Capital Markets and Simmons & Company International.

Business overview

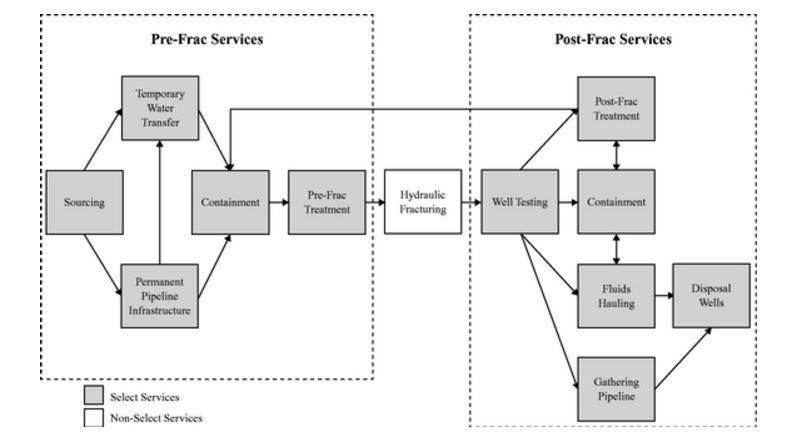

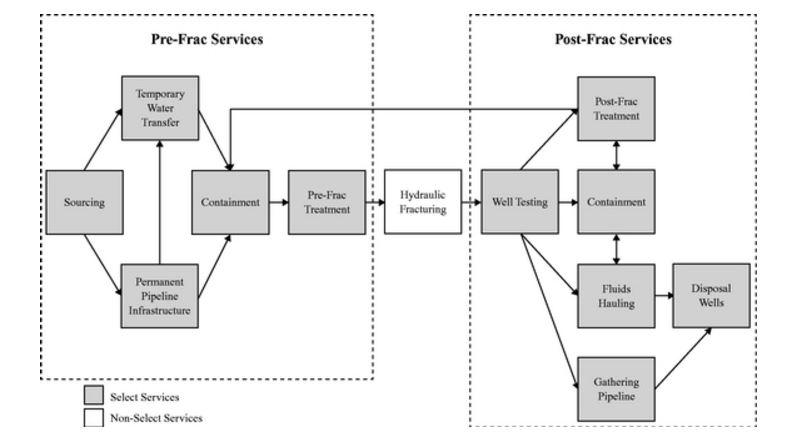

Based in Gainesville, Texas, Select Energy Services offers total water solutions to the unconventional oil and gas industry in the U.S. It sources and transfers water to sites before it is used in drilling and completion activities associated with hydraulic fracturing. The company provides well completion services before and after fracking. Its other water services include: treatment, containment, flow back, monitoring, hauling and disposal. The company has a broad footprint in many of the various oil basins in the U.S. Its strongest presence is in the Permian Basin in Texas.

Major investors include: Adage Capital Partners L.P., Hadley Harbor Master Investors (Cayman) L.P., Luminus Energy Partners Master Funds, Ltd., Putnam Funds, Senator Global Opportunity Master Funda L.P., Teacher Retirement System of Texas II L.P., Whipstock Co-Investment Fund II L.P., SES Legacy Holdings LLC, and Crestview Partners II GP, L.P.

The picture below shows the various services Select Energy Services provides during the completion cycle of a horizontal well.

(Select Energy Services)

Executive management team

John Schmitz has served as the chairman and chief executive officer of Select Energy Services since Nov. 2016 and as the CEO and chairman of SES Holdings since the company was originally founded as Peak Oilfield Services LLC in 2007. Schmitz founded SES and all of its predecessors. Previously, he was the division manager in North Texas for Complete Production Services Inc. before it was sold to Superior Energy Services. He founded a predecessor company to BSI Holdings Inc. that was called Brammer Supply Inc. in 1983, which was rebranded under the Complete Energy Services umbrella in 2003. He is also the founder and chairman of Silver Creek Oil & Gas as well as the founder of multiple other companies.

Leave A Comment