– Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans

– Italy’s banks weighed down under €318bn of bad loans

– New ECB rules could ‘derail’ any recovery in Italy’s financial system

– Draft proposal requires banks to provision fully for loans that turn sour from 2018

– ECB insists banks have better access to collateral on delinquent debt to solve problem

– Investors should secure assets as proposal suggests more bailins on horizon and banks remain at risk

Source: ilsole24ore.com

Another week and another unjustifiable move by the ECB to ‘protect’ the EU’s banking system. This time it is the decision to toughen bad-loan rules for euro-area banks.

The rules state that banks must be held to firm deadlines for writing down loans that turn sour. Banks will be required to provision fully for loans that turn sour from the start 2018.

This is particularly bad news for Italy. The country has over €318 billion of bad loans. Should the banks be forced to dispose of these non-performing loans too quickly then a financial disaster could be triggered, derailing any form of recovery

This is a step too far for Italy’s bankers who argued the ECB had overstepped its supervisory role, instead enforcing measures that should only be enforced by lawmakers.

Should they be enforced these new measures will not only put extra pressure on smaller banks but result in yet more savers and businesses losing money. The idea that these new policies will be beneficial for all is arguably laughable. Especially when one looks at the overall state of the Italian banking system.

The Texan warning signal

The health of a bank’s non-performing loans (NPLs) can be measured using the Texas ratio. This is a measure of bad loans as a proportion of capital reserves. When the reading is over 100 it is a warning signal the banks need a solution quickly.

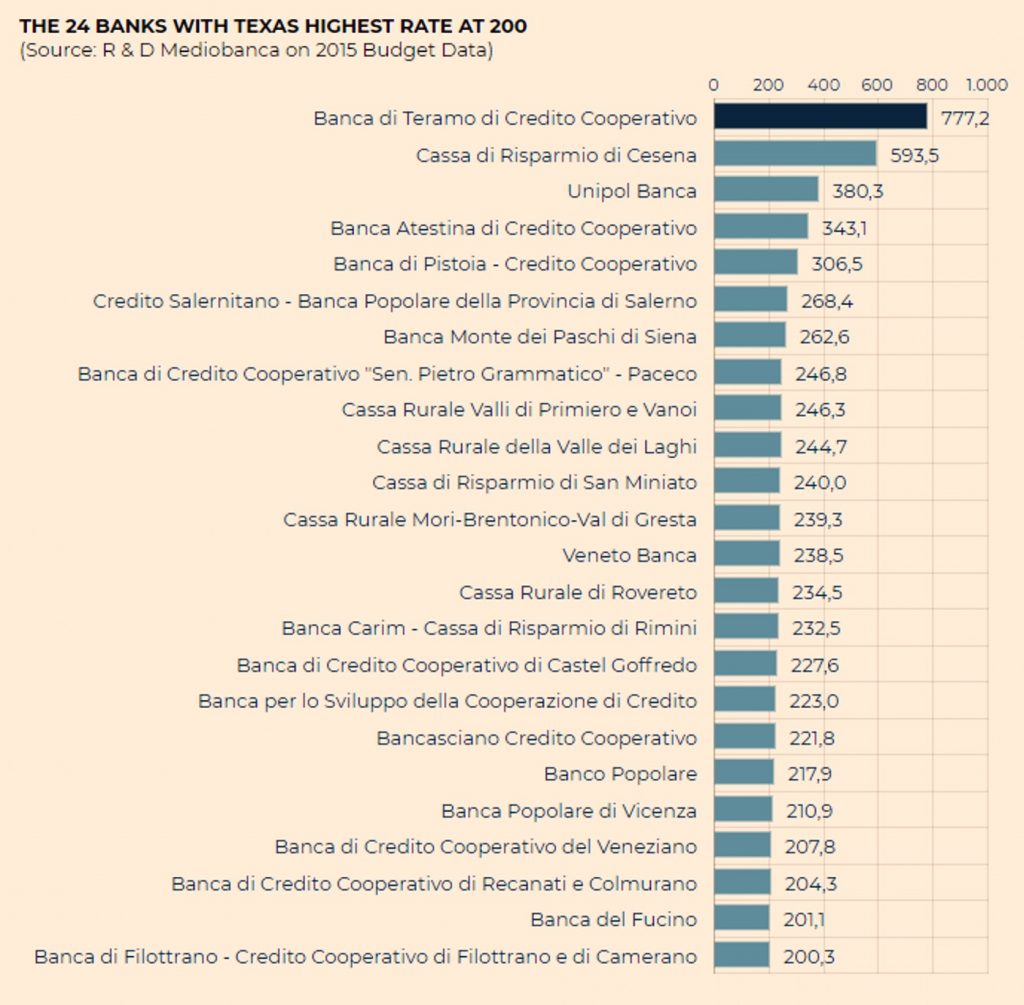

Data cited in a March 2017 article shows that 23% of Italy’s near 500 banks are showing signs of severe stress. 24 of the banks that have a Texas ratio reading of over 200.

The bureaucrats in the likes of the ECB aren’t worried about the majority of the Italian banks with a Texas ratio of over 100 as they are small local or regional savings banks with tens or hundreds of millions of euros in assets. But when a reading of over 100 basically means they don’t have enough money to pay for the bad loans, what happens to the people who have their money with these small banks?

Leave A Comment