The September natural gas contract fell almost a percent and a half again today as balances continued to loosen over the weekend and forecasts cooled slightly.

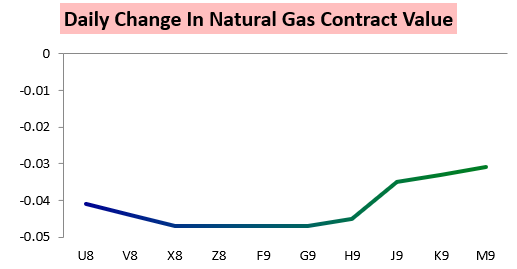

The entire strip got hit today, with lingering cash strength on short-term heat actually propping up the September contract slightly.

The result was a tick higher in the U/V September/October contract spread as we approach contract expiry.

Meanwhile, our Morning Update highlighted slight GWDD losses over the weekend, even though we still expect cooling demand to run solidly above average over the next couple of weeks.

Today’s Update also further validated our Natural Gas Weekly Update from last Monday that highlighted that a short-term bounce into $2.98-$3 would fail and that into early this week downside should open up for prices as long-range forecasts fail to maintain heat and balances continue to loosen.

Meanwhile, traders are beginning to focus on the EIA data expected out on Thursday. Some of the first data for it was released today, with Dominion Transmission announcing an injection of 8 bcf last week following an injection of 9 bcf the week prior.

Leave A Comment