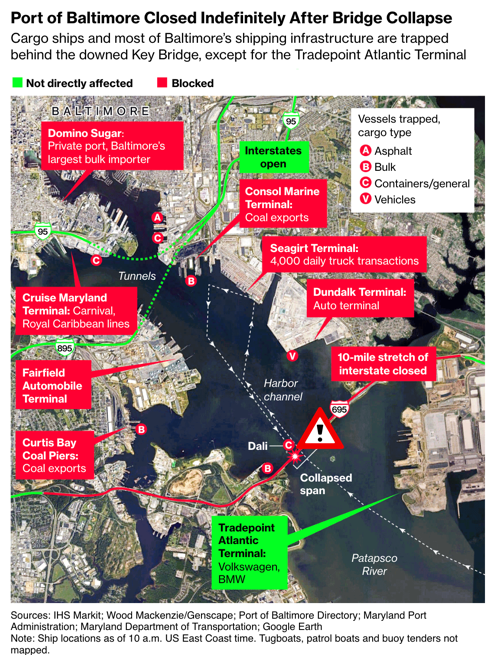

US Transportation Secretary Pete Buttigieg told CBS’s Face the Nation on Sunday that there is no timeline on when salvage crews in Baltimore, Maryland, will clear the critical shipping channel blocked by the wreckage of the collapsed Francis Scott Key Bridge. He said it’s important “to our national supply chains to get that port back up and running as quickly as possible.”

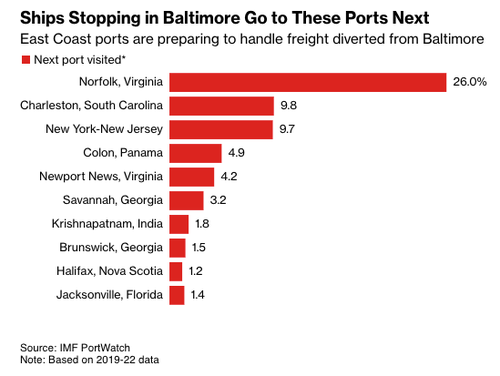

On Monday morning, Port of Virginia, just south of Baltimore and at the mouth of the Chesapeake Bay near Norfolk, will open one hour early (0500 ET) to ramp up more trucking capacity as diverted cargo from Baltimore is offloaded. Bloomberg noted that a major railroad had expanded its services. Sanne Manders, president of international operations at digital freight platform Flexport, said other East Coast ports “can easily absorb the immediate aftermath on containerized trade.” Manders said that even though the port will reopen once salvage crews clear the shipping lane of debris, there will be “severe” consequences for the Port of Baltimore because the bridge once served as a critical “feeder into the port.”

On Monday morning, Port of Virginia, just south of Baltimore and at the mouth of the Chesapeake Bay near Norfolk, will open one hour early (0500 ET) to ramp up more trucking capacity as diverted cargo from Baltimore is offloaded. Bloomberg noted that a major railroad had expanded its services. Sanne Manders, president of international operations at digital freight platform Flexport, said other East Coast ports “can easily absorb the immediate aftermath on containerized trade.” Manders said that even though the port will reopen once salvage crews clear the shipping lane of debris, there will be “severe” consequences for the Port of Baltimore because the bridge once served as a critical “feeder into the port.”

“The longer-term aftermath will probably be more severe, because even if you take away the debris from the port, that is an extremely important bridge as a feeder into the port, and traffic will have to reroute a long, long way.”

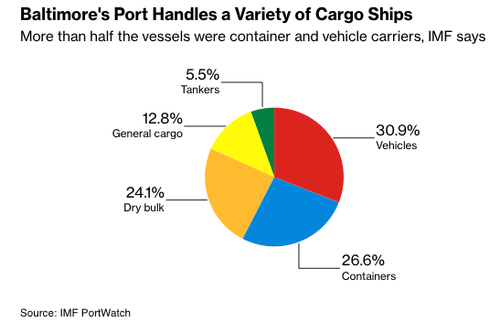

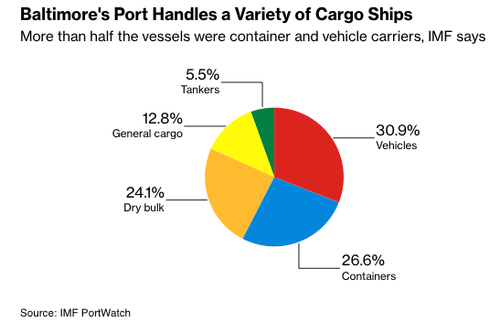

According to an analysis from the International Monetary Fund’s PortWatch platform, Norfolk, New York, and Charleston, South Carolina, are the ports most likely to absorb cargo.

While East Coast ports will easily absorb diverted cargo from Baltimore, Governor Wes Moore warned the port closure will have severe ripple effects across the city, surrounding counties, the state, Mid-Atlantic, and even the eastern half of the US:

While East Coast ports will easily absorb diverted cargo from Baltimore, Governor Wes Moore warned the port closure will have severe ripple effects across the city, surrounding counties, the state, Mid-Atlantic, and even the eastern half of the US:

“This port is one of the busiest inside the country, so this will impact the farmer in Kentucky, and the auto dealer in Ohio and the restaurant owner in Tennessee.”

Last week, credit ratings agency Moody’s warned that the prolonged closure of the port would ripple through the local economy and could spark negative credit risk events for the city and state:

Last week, credit ratings agency Moody’s warned that the prolonged closure of the port would ripple through the local economy and could spark negative credit risk events for the city and state:

The bridge collapse threatens to disrupt aspects of the State of Maryland (Aaa stable) and City of Baltimore (Aa2 stable) economies. The suspension of shipping traffic to the Port of Baltimore will likely divert cargo to other East Coast ports, which may affect jobs and tax revenue. The accident also has the potential to hurt the transportation and warehousing sector, though that accounts for a small share of state GDP.

More from Moody’s about the credit fallout that could soon hit Baltimore:

In recent years, the state and Baltimore County (Aaa stable) have provided incentives and worked with developers to facilitate the redevelopment of Sparrows Point, a more than 3,000-acre contaminated industrial site once home to a Bethlehem Steel plant. Over the last nine years, Sparrows Point has seen almost $2 billion of private investment resulting in the development of 14 million square feet of warehousing and distribution facilities. With the Key Bridge providing the only direct access route between Sparrows Point and Baltimore/Washington International Thurgood Marshall Airport, further development at Sparrows Point could be delayed.

The one question that baffles us is why Baltimore didn’t install barriers or pilings around critical bridge supports to prevent ship strikes during major port expansions over a decade ago. More By This Author:ESG Frustration And Backlash In The Banking Sector ContinuesStocks, Gold, & Crypto Soar In Q1 Despite Rout In Rate-Cut ExpectationsPhiladelphia Fed Admits US Payrolls Overstated By At Least 800,000

Leave A Comment