Stock market crash ahead?

The “Icarus Trade” is still in play according to Bank of America Merrill Lynch’s Chief Investment Strategist Michael Hartnett.

Named after the infamous son of craftsman Daedalus in Greek mythology, Hartnett’s Icarus Trade is an attempt to call the top of the recent market rally.

Hartnett and team believe the market will continue to rally until it reaches the “Icarus Trade” targets of 2,500 for the S&P 500, 3.5% for the US 30-year, 110 on the DXY and oil at $70/bbl.

Just like Icarus, after soaring to these levels, Bank of America’s analysts believe the market will crash back to earth as support vanishes.

Bank Of America Calls The Top Of The Stock Market

Even though such bearish forecasts are usually proven, incorrect Hartnett’s “Icarus Trade” has garnered plenty of attention thanks to its unbridled optimism but also caution, although the bank’s analysis stops short of revealing when it expects Icarus’s wings to melt.

Odey Quiet In Latest Letter As Hedge Fund Heads For

Top of the stock market?

All Hartnett will say is that the market will most likely fall during the second half of 2016. The current US equity bull market is already the 2nd longest ever and will become the longest ever if it runs past August 22nd, 2018 and; the bull market will become the 3rd largest ever at 2,467 on the S&P 500.

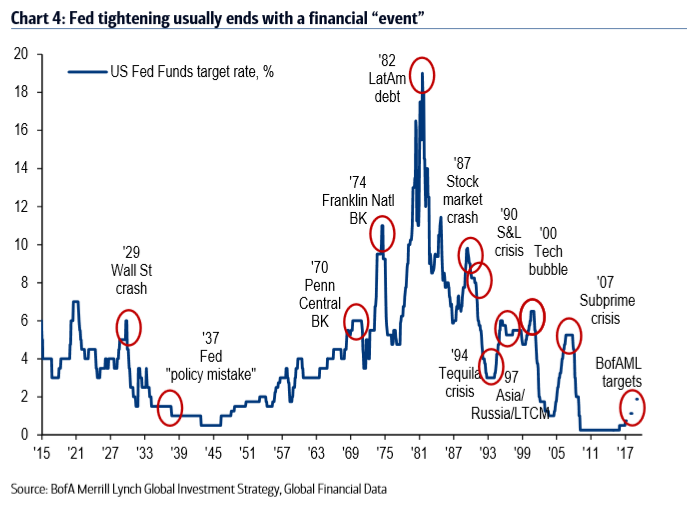

JHL Capital’s James Litinsky: A 1% Rate Hike Could Cause A Crash

The terminal point will likely come once the Fed gets going raising rates. Higher rates will coincide with a bear flattening of the yield curve and lower earnings expectations. “Like Humpty-Dumpty, risk assets will invariably have a great fall once the “wall of worry” is climbed and investors stop worrying.” Historically, once the Fed starts tightening, it keeps tightening until there is a “financial event” and Hartnett notes that this time around, considering how low-interest rates have been for so long, “this is likely to occur at a much lower rate of interest.” The timeline for this rate inspired crash is uncertain, but later this month the Fed will likely tighten for the second time in three months, causing “a jump in the Fed funds rate to 1.5-2% by early 2018”. Higher rates expectations will take some time to filter through. Bank of America’s strategy team expects higher rates to start having an impact on economic data by the end of the summer. Still, before the next great crash unfolds, Hartnett believes the March hike will cause bears to fully capitulate into risk assets causing a melt up towards the targets listed above.

Leave A Comment