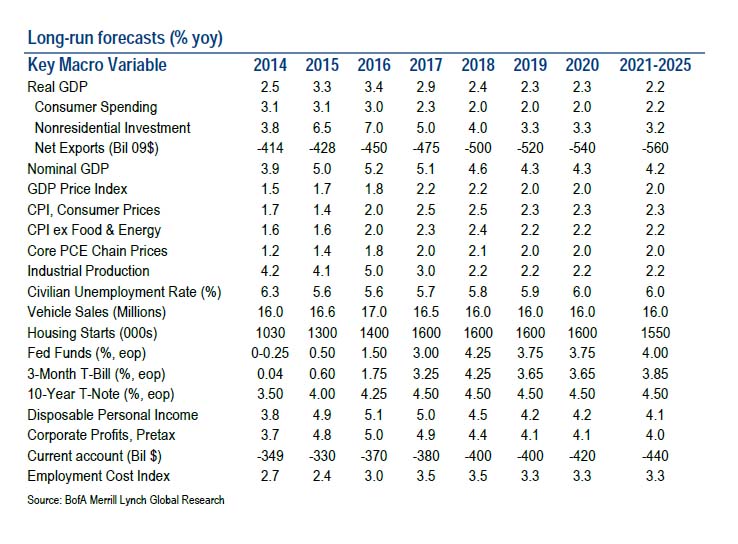

A year and a half ago, in May of 2014, when Bank of America’s chief economist Ethan Harris decided to try his hand at long term (really long-term) forecasts, he made several predictions: that 2015 GDP would be 3.3%, that the long-term potential growth rate of the economy is 2.2%, and that the long-term unemployment rate is 6%.

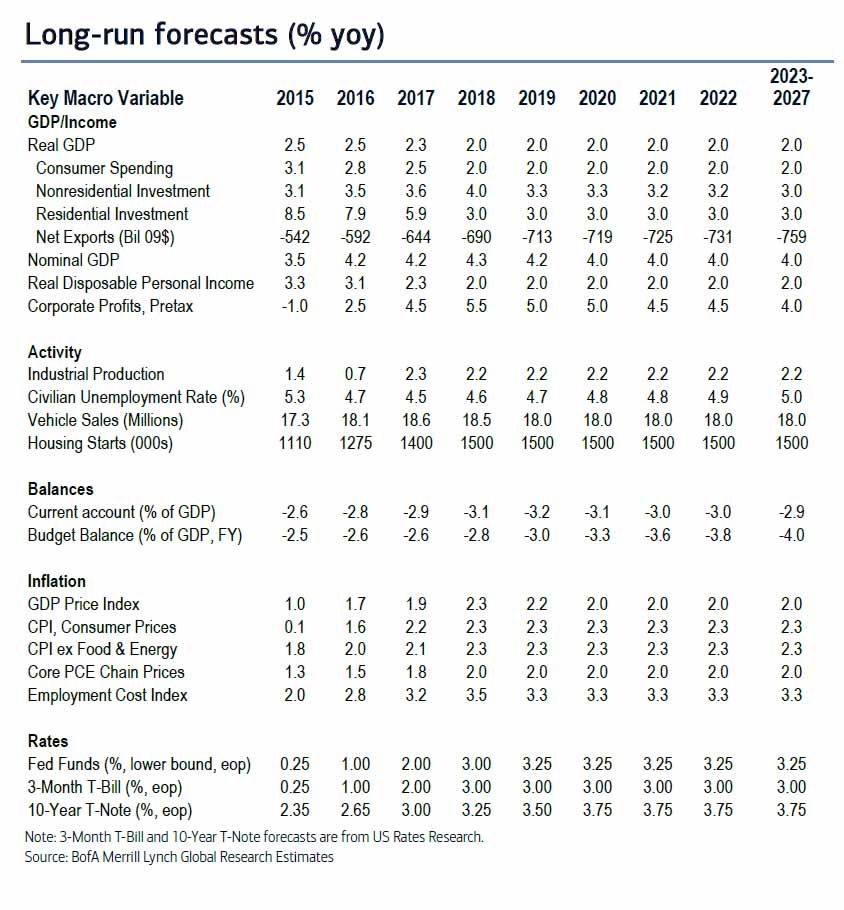

One year later, we yet again see just why economists tend to be a source of amusement everywhere they go, because moments ago the same Mr. Harris just admitted that 2015 GDP would actually be 2.5% (at best, and realistically 2.1% if Q4 GDP ends up being 1.8% as the Atlanta Fed forecasts), that the long-term growth rate is now lower at 2.0%, even as the long-term unemployment rate has mysteriously declined to 5%, or in other words, a lower potential growth rate results in lower unemployment.

Go figure.

Here is what Harris predicted for the “long-term” in early 2014:

And here is his same forecast as released earlier today:

We leave it up to readers to spot the amusing, if startling, differences.

And yet one thing that hasn’t changed in the past 18 months is that like then, so now, Bank of America refuses to forecast a recession any time in the next 12 years! To wit:

Obviously, there is considerable uncertainty in forecasting many years out, so these should be viewed as rough baseline numbers. For example, if history is our guide, at some point in the next decade the US will experience a recession, but predicting a recession far in advance is almost impossible.

So predicting a recession at some point in the next 12 years impossible, but predicting next year’s GDP is “possible”… assuming one has a 25% error rate tolerance.

But if you think that is amusing read the following from another BofA prognosticator, its “Equity & Quant Strategist” Savita Subramanian. This is presented without comment.

S&P 500 targets: 2200 in 2016 and 3500 by 2025

We expect modest gains for US large cap stocks in 2016: the likelihood of a recession in the next 12 months is low in our view, but valuations have normalized from previously low levels and narrowing returns are to be expected. Our forecast represents a 5% rise from current levels, roughly equivalent to earnings growth, where we forecast 2016 EPS of $125.

10-year S&P 500 forecast: 3500 (+67%)

Our work suggests that valuation is a poor short-term timing indicator, but the single most important determinant of long-term returns. Valuations have historically explained 60-90% of subsequent returns over a 10-year time horizon – see Table 2. Normalized P/E – our preferred valuation metric – has explained 80-90% of returns over the subsequent 10-11 years.

Based on current valuations, a regression analysis suggests compounded annual returns of 8% over the next 10 years with a 90% confidence interval of 4-12% (Table 2). While this is below the average returns of 10% over the last 50 years, asset allocation is a zero-sum game. Against a backdrop of slow growth and shrinking liquidity, 8% is compelling in our view. With a 2% dividend yield, we think the S&P 500 will reach 3500 over the next 10 years, implying annual price returns of 6% per year.

Leave A Comment