It has been a trying time for the world’s central bankers, who for decades have been used to the “high finance” community’s adulation, derived from the deliverance of policy wrapped in so much opacity, gibberish and contradictions, that neither the central bankers, nor the markets, had any idea what was going on (see the Greenspan tenure), or dared to admit it was all meaningless drivel, resulting in phases during which the market was on “autopilot” and culminating with a bubble and subsequent crash, “rescued” by an even greater asset bubble and even greater crash, etc.

However, after generations of largely uncontested and unquestioned monetary policy where only the occasional “tinfoil” fringe blog dared to say that central banker emperors are not only naked and clueless but are also the cause of the world’s biggest problems, more and more voices are emerging to both challenge the prevailing monetary religious dogma, as well as daring to do something unprecedented: tell the truth.

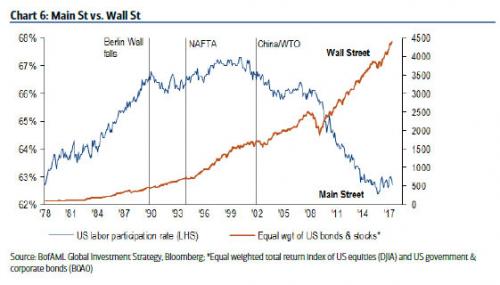

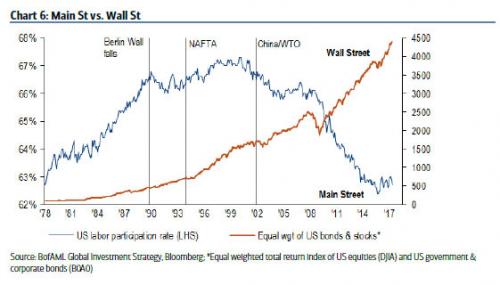

One example was Bank of America’s chief strategist, Michael Harnett, who on Friday confirmed what we had been saying for years, that “central banks have exacerbated inequality via Wall St inflation & Main St deflation” and that the Fed failed in its mission to make the poor richer, instead its destructive policies have made the top 1% wealthier beyond its wildest dreams, and have been directly responsible for such political outcomes as “Brexit” and “Trump.”

Then there was the WSJ, which on the front page, led with a headline that would have been anathema for “established” (i.e. sycophantic) financial journalism as recently as a few years ago:

“Are Central Bankers Twisted Geniuses Or Bumbling Ex-Academics” the WSJ blasted on its front page, with James Mackintosh writing the following:

Are central bankers twisted geniuses manipulating the markets in order to meet their inflation goals?Or are they bumbling ex-academics whose ramblings are overinterpreted by investors besotted with their brilliance?

Leave A Comment