Reading the media headlines suggests that the brick-and-mortar retail business model is dying as consumers shift their business to e-Commerce companies like Amazon (AMZN).

While this market pessimism is weighing on the stock prices of retailers in the short-term, it is highly likely that traditional retail shopping will never truly die…

…which means the current retail downturn could be a buying opportunity.

“The time to get interested is when no one else is. You can’t buy what is popular and do well.”

There is perhaps no company that embodies a victim of Amazon more than Barnes & Noble (BKS).

After all, Amazon originally started as an online bookstore, and Barnes & Noble sued Amazon for falsely advertising as ‘the world’s largest bookstore’ in the ’90s. The companies settled for an undisclosed amount.

The effect of Amazon on Barnes & Noble’s business has caused their stock price to drop materially, even though Barnes & Noble is a well-known blue chip stock. The Blue Chip Stocks Excel Sheet contains pertinent investment information on a wide variety of blue chip stocks (including Barnes & Noble).

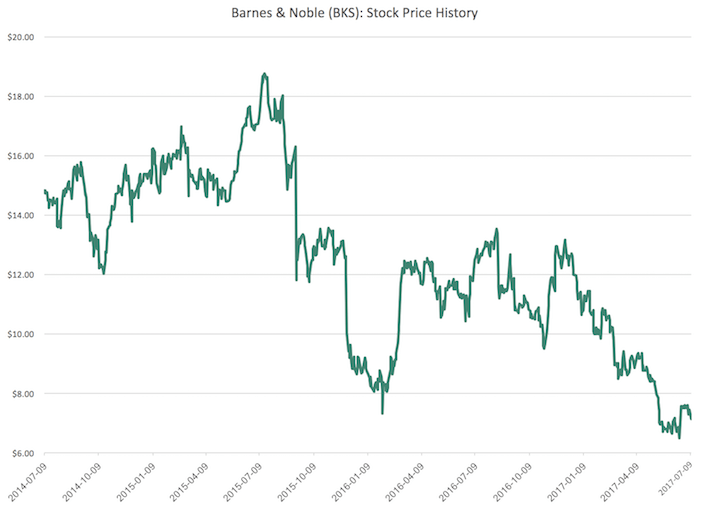

More specifically, Barnes & Noble’s stock has lost more than 50% of its value over the past 3 years.

Source: YCharts

Barnes & Noble’s stock price suggests that its business is failing. If this is notthe case (in other words, if this is a market overreaction), then Barnes & Noble is likely providing a compelling buying opportunity today.

This is especially true for dividend investors. After all, a declining stock price results in a higher dividend yield, all else being equal.

Barnes & Noble’s recent stock price movement has pushed its dividend yield north of 8%. The High Dividend Stocks Excel Sheet contains pertinent investment information on 405 securities (including Barnes & Noble common shares) with 5%+ dividend yields.

This article will assess the investment prospects of Barnes & Noble in detail.

Business Overview

Barnes & Noble is the nation’s largest bookstore company. As of April 29, 2017, the company operated 633 bookstores in all 50 states.

Barnes & Noble serves 30 million customers, 6 million Barnes & Noble ‘members’ (the company’s loyalty program), and delivers a complete multi-channel offering through barnesandnoble.com and its NOOK e-reader platform.

Leave A Comment