My Swing Trading Approach

My portfolio is strong right now, and looking to manage profits and current positions. I am not looking to add more long exposure here.

Indicators

VIX – VIX rose by only 1.2% yesterday – a small amount, and nothing eye opening.

T2108 (% of stocks trading below their 40-day moving average): Another big move, rising 10% yesterday to 65%. Ideally, the bulls should be at +75% right now, and that is a concern, .

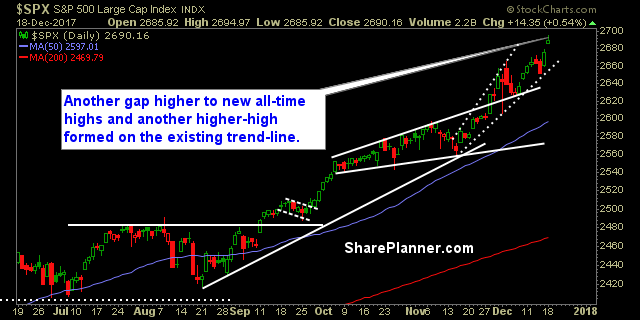

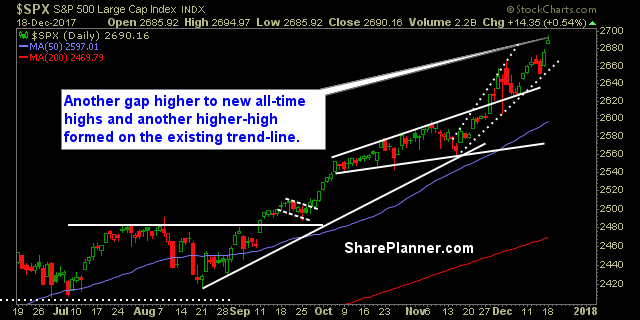

Moving averages (SPX): Trading above all major moving averages.

Industries to Watch Today

Basic Materials continue on its monster run – very bullish as does Cyclicals. Technology still on a nice rebound and Real Estate making a big move of its own. Utilities rolling over.

My Market Sentiment

December remains the bullish month of choice, and showing exactly why. There is still room for this market to run in the short-term, and may very well see, a melt-up into the end of year.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment