Written by SmallCapPower.com

Long-term investors should consider investing in the telecom behemoth BCE Inc. (TSX: BCE)(BCE), which continues to exhibit healthy fundamentals. The recent correction of ~9% from the 52-week high of $63.41 seems to be a good entry point for investors.

Investment Thesis

Diverse business streams

BCE is a well-diversified organization with a commanding position in the wireless and wireline industry. Additionally, the Company has significant media assets, real estate holdings and a professional sports team. The wireless and wireline segment are the main contributors to the revenues for BCE.

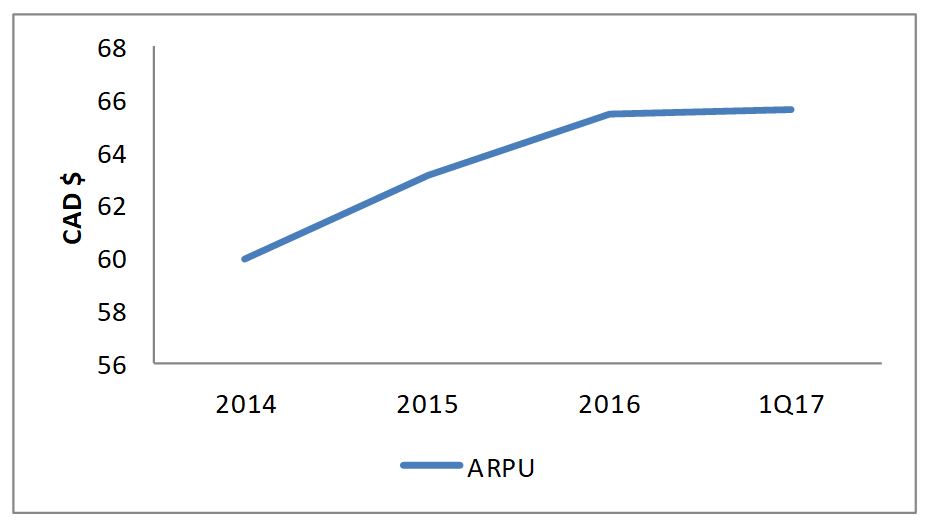

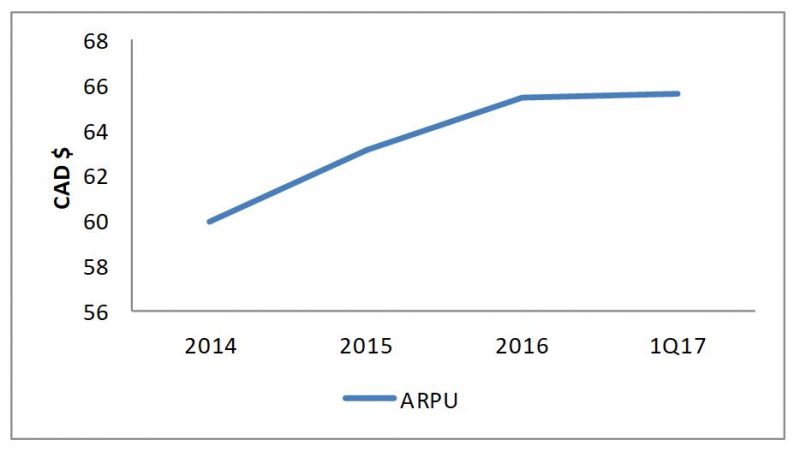

Healthy ARPU

The average revenue per user (ARPU) has been increasing year over year for BCE, indicative of higher LTE usage and healthy growth in subscribers. The Company is focusing on increasing ARPU by concentrating on expansion and retention of their subscriber base and by creating products & services to add value. In FY16, BCE reported ARPU of $65.46, which was ~4% higher than the FY15 level. Additionally, the ARPU for 1Q17 came in at $65.66.

Future synergies with MTS acquisition

The acquisition of MTS provides BCE with a wider broadband scale and operational synergies worth approximately $100 million, which are higher than the original estimate of $50 million. With this acquisition, BCE becomes the Number One wireless provider in Manitoba. MTS adds ~700k wireless, Internet and IPTV subscribers in Manitoba. With MTS, BCE will cover 11.2 million of Canada’s 15.4 million total households.

Attractive dividend yield and EPS

BCE Inc. provides investors with an attractive dividend yield, which is higher than its competitors. The current dividend yield of the Company is 4.7%, compared to the peer average of 3.5%. We expect BCE to maintain its dividend payout in the future. Furthermore, BCE has a handsome earning per share of $3.3 as compared to the peer average of $0.2.

Leave A Comment