Headquartered in New York, Avon Products (AVP) is the world’s largest direct seller with about 6 million active independent sales representatives. Avon products include color cosmetics, skincare, fragrance, fashion and home products, under brand names like Avon Color, ANEW, Skin-So-Soft and Advance Techniques.

In March last year, Avon split into two companies–Avon Products, a publicly traded company that operates in approximately 70 countries and New Avon LLC, a privately-held company owned by Cerberus Capital Management, and operating in the US, Puerto Rico and Canada.

Disappointing Results

The company reported adjusted earnings of $0.01 per share for Q4 missing the Zacks Consensus Estimate of $0.09. Revenues fell 2% year over year and were also short of the Zacks Consensus Estimate.

The miss was attributed to a decrease in the number of selling representatives and currency headwinds.

Update on Transformation Plan

The company also provided an update on the Transformation Plan, which was initiated in January 2016, and aims to achieve its long-term goal of a targeted low double-digit operating margin and mid single-digit constant-dollar revenue growth. The plan focuses on investing in growth, reducing costs and improving financial resilience.

Falling Estimates

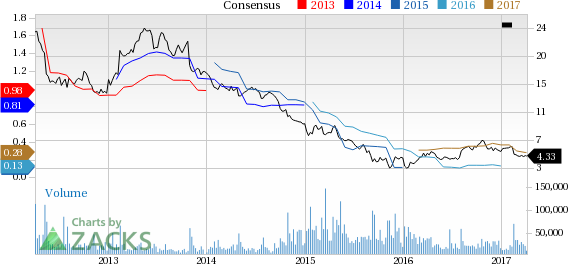

Analysts have been slashing their estimates after lackluster results. Zacks Consensus Estimates for the current and nest year have fallen to $0.28 per share and $0.36 per share, down from $0.37 and $0.50, before the results.

The company has missed in three out of last four quarters with an average negative quarterly surprise of about 109%.

The following chart shows the negative earnings and price momentum for AVP:

Avon Products, Inc. Price and Consensus

Avon Products, Inc. Price and Consensus | Avon Products, Inc. Quote

Better Play in the Industry?

Cosmetics industry is currently ranked 188 out of 265 Zacks industries (bottom 29%). Investors should avoid the industry as of now.

Leave A Comment