Bank OZK (OZK – Free Report) shocked Wall Street by taking a large charge for real estate loans gone bad. This Zacks Rank #5 (Strong Sell) has seemingly been infallible to real estate losses, until now.

Investors are left wondering, what will be next?

Bank OZK is headquartered in Arkansas and has $22 billion in assets. For years, it was considered a growth story, and not a value-banking story, as it aggressively expanded its real estate portfolio after the Great Recession when many other banks stayed on the sidelines.

Big Miss in Q3

On Oct 18, Bank OZK reported third quarter results and shocked the Street by missing on the Zacks Consensus Estimate by $0.32. Earnings came in at just $0.58 versus the Zacks Consensus of $0.90.

Why the big miss?

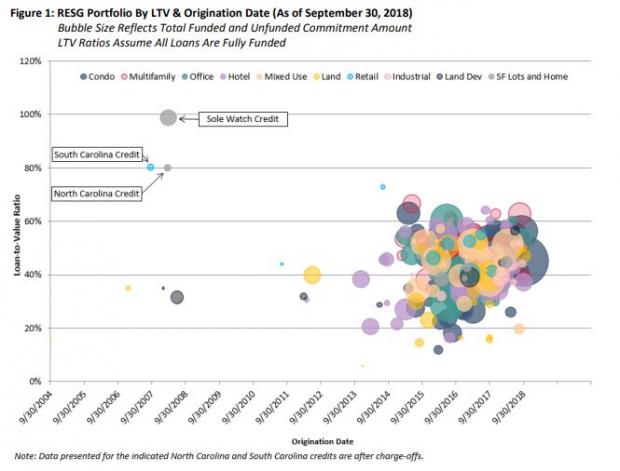

It took a $45.5 million charge on 2 loans in its Real Estate Specialties Group (“RESG”), one in South Carolina and one in North Carolina. The two loans were not related.

One was for a regional shopping mall property which was anchored by struggling retailers JCPenney and Sears, and the other was for a housing and land single family home development.

The loans were from 2007 and 2008, respectively.

On the conference call, OZK tried to reassure the analysts that these were isolated incidents. They don’t have much exposure to the retail problems at shopping malls, outside of this property.

In a special “Management Comments” attachment, Bank OZK highlighted its loan portfolio origination dates, which is helpful.

But this just made investors more jittery.

If these two old loans went bad, who’s to say some of the newer ones won’t as well?

Estimates Slashed

Due to the big miss, the analysts moved to cut 2018 and 2019 full year estimates.

The 2018 Zacks Consensus Estimate fell to $3.28 from $3.62 in the last 90 days. That’s still earnings growth of 10%, however, as the bank made $2.96 in 2017.

But they also cut 2019 estimates as well, as the Zacks Consensus fell to $3.54 from $4.00 over the last 3 months.

Leave A Comment