While Macy’s (M – Analyst Report) shares might seem a value trading under 10 times next year’s $4 EPS estimate, the problem is that those estimates keep falling.

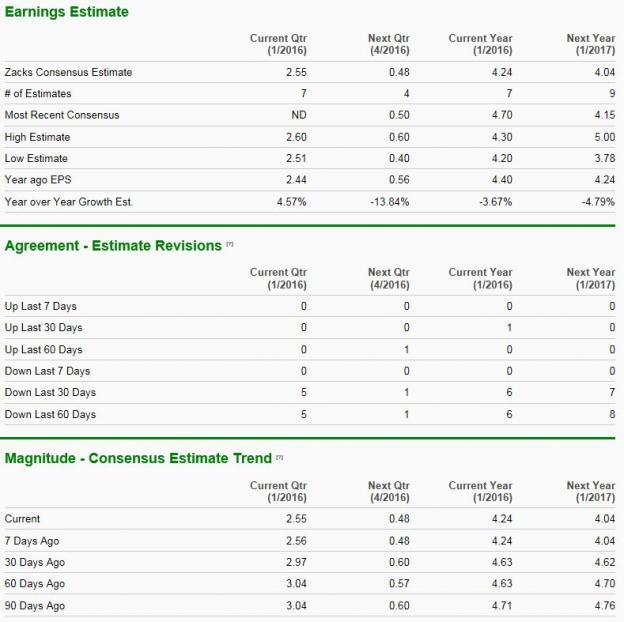

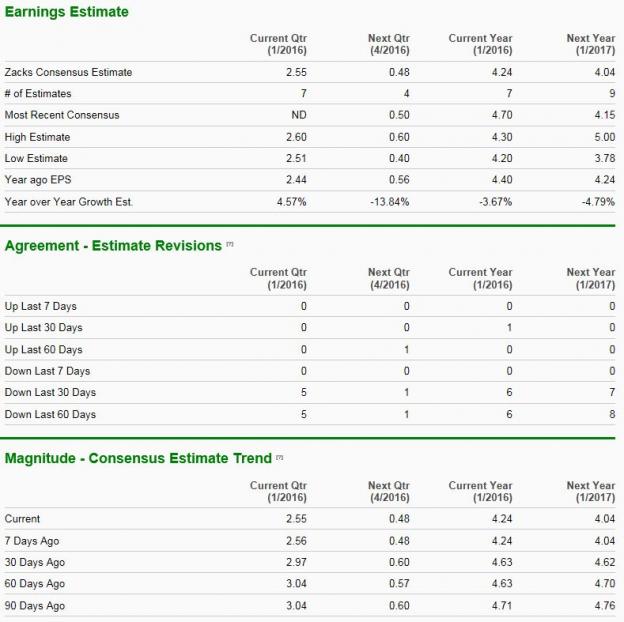

For the current fiscal year which ends in January, full-year EPS projections dropped from $4.71 to $4.24 in the past 90 days.

And next year’s EPS estimates were slashed by 15% from $4.76 to $4.04. Clearly, growth just went negative for the big M.

Here are the Zacks Detailed EPS tables which show how the consensus estimates have fallen away in the past quarter…

But the best way to visualize this waterfall decline in the Macy’s earnings outlook is via the Zacks proprietary Price & Consensus chart which plots changes in annual EPS estimates against price…

I don’t know all the Retail sector and industry trends deeply enough to conjecture about the future of Macy’s for investors. Clearly, so much shopping has migrated to online venues that you can probably predict as well as I which jungle the money is flowing through.

Into the Jungle, or the Ether

But Amazon (AMZN – Analyst Report) and it’s ilk aren’t getting all the lost “bricks” business either.

I learned about an interesting aspect of this puzzle from our resident economist John Blank last month. He recently saw noted Retail expert Dana Telsey speak in LA and she talked about the “invisible” sales making it hard to track the success or demise of some retail business models. Here’s how John summed it up for me…

“She basically said she thought this Xmas shopping season looked soft at retail. One of the new issues to look out for, in terms of retail competition, she said is the ‘invisible’ loss of market share. The idea is that young girls etc. are emailing and texting one another pics of their favorite look and buying it. Then, the sales disappear at retail. The store retailer doesn’t really know who took the business. With Snapchat, Instagram and other services doing the legwork, it is impossible to tell right now.”

Leave A Comment