Last week, I discussed the boost the market received as the BOJ made an unexpected move into negative interest rate territory combined with end of the month buying by portfolio managers. To wit:

“However, the announcement by the Bank of Japan (BOJ) to implement negative interest rates in a desperate last attempt to boost economic growth in Japan was only the catalyst that ignited the bulls. The “fuel” for the buying came from the end of the month portfolio buying by fund managers.”

But more importantly, was the push higher by stocks that I have been discussing with you over the last couple of weeks. To wit:

“Over the last few weeks, I have suggested the markets would likely provide a reflexive rally to allow investors to reduce equity risk in portfolios. This was due to the oversold condition that previously existed which would provide the “fuel” for a reflexive rally to sell into.

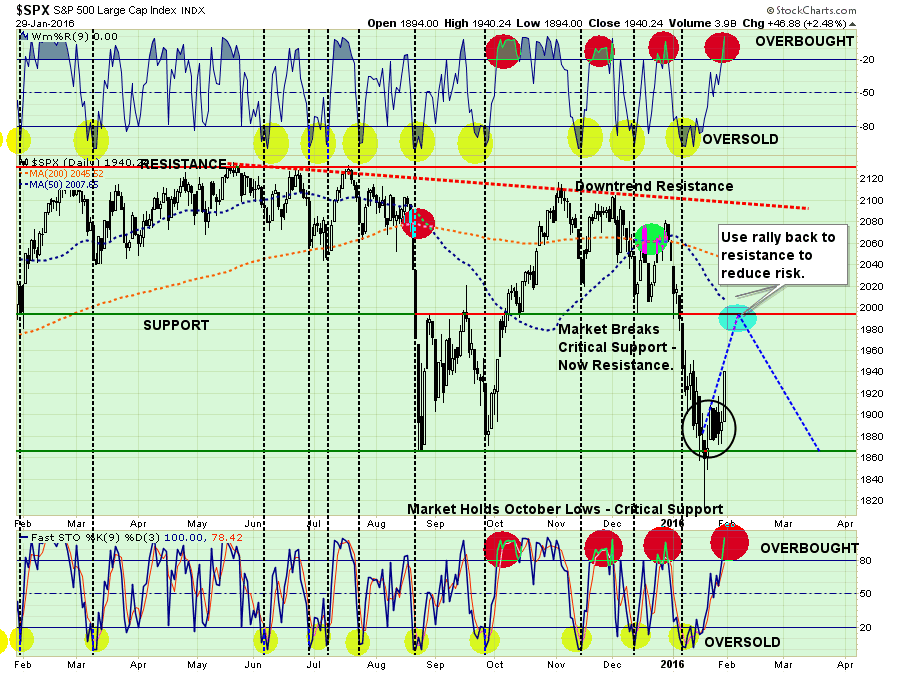

I traced out the potential for such a reflexive rally two weeks ago as shown in the chart below.”

Previous Chart

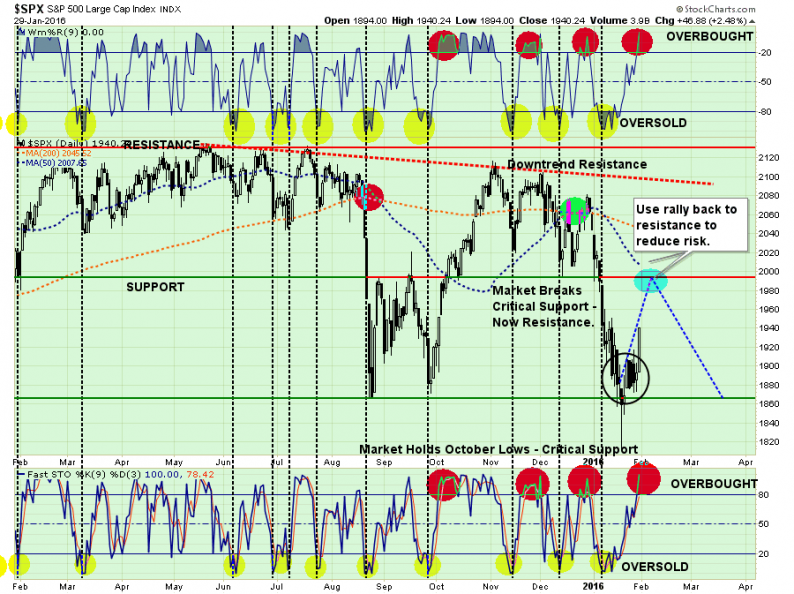

As I stated then, the most important parts of the chart above are the overbought/oversold indicators at the top and bottom. The oversold condition that once existed has been completely exhausted due to the gyrations in the markets over the last couple of weeks. This leaves little ability for a significant rally from this point which makes a push above overhead resistance unlikely.

“Just as an oversold condition provides the necessary “fuel” for an advance, the opposite is also true.”

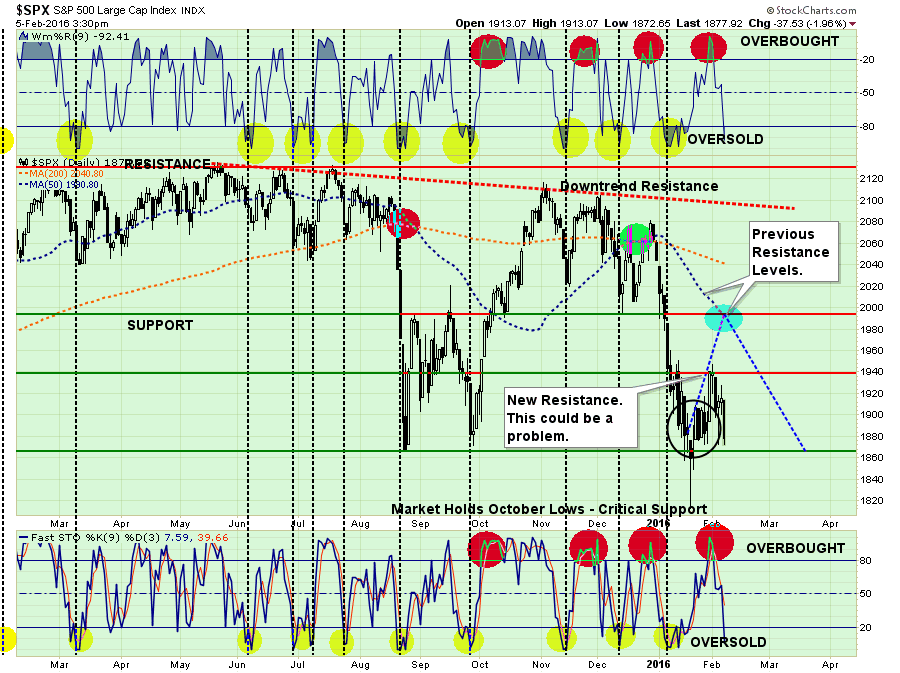

Here is the problem. I have updated the chart above through Friday’s close.

The rally failed at the previous reflex rally attempt during the late December/January plunge. This failure now cements that high point as resistance. Furthermore, the market continues to fail almost immediately when overbought conditions are met (red circles), which suggests that internals remain extraordinarily weak.

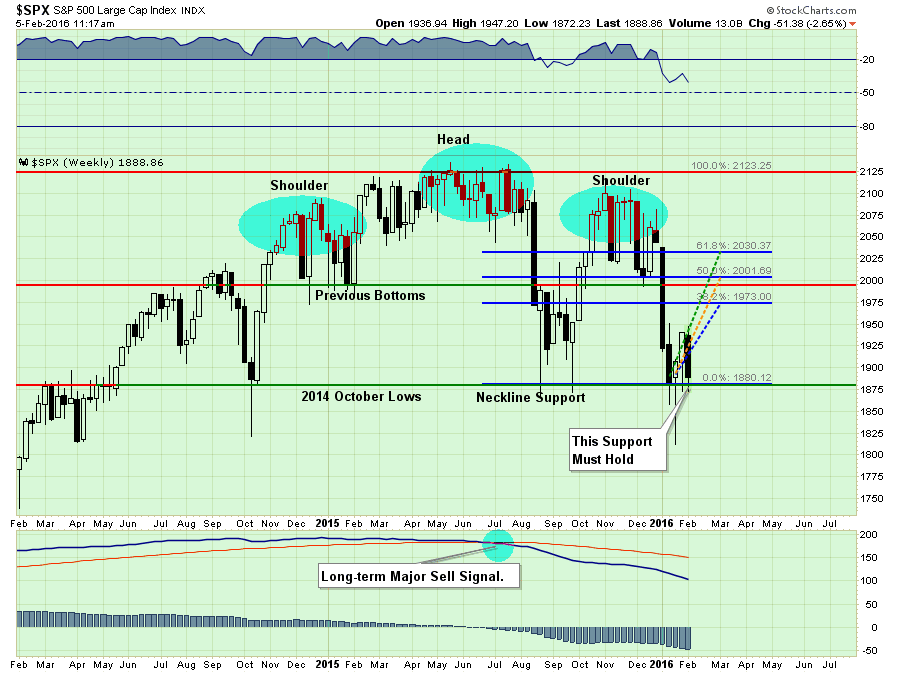

Head & Shoulders – Not Just Dandruff

The good news, if you want to call it that, is that the market is currently holding above the recent lows as short-term oversold conditions once again approach. It is critically important that the market holds above that support, which is also the neckline of the current “head and shoulders” formation, as a break would lead to a more substantive decline.

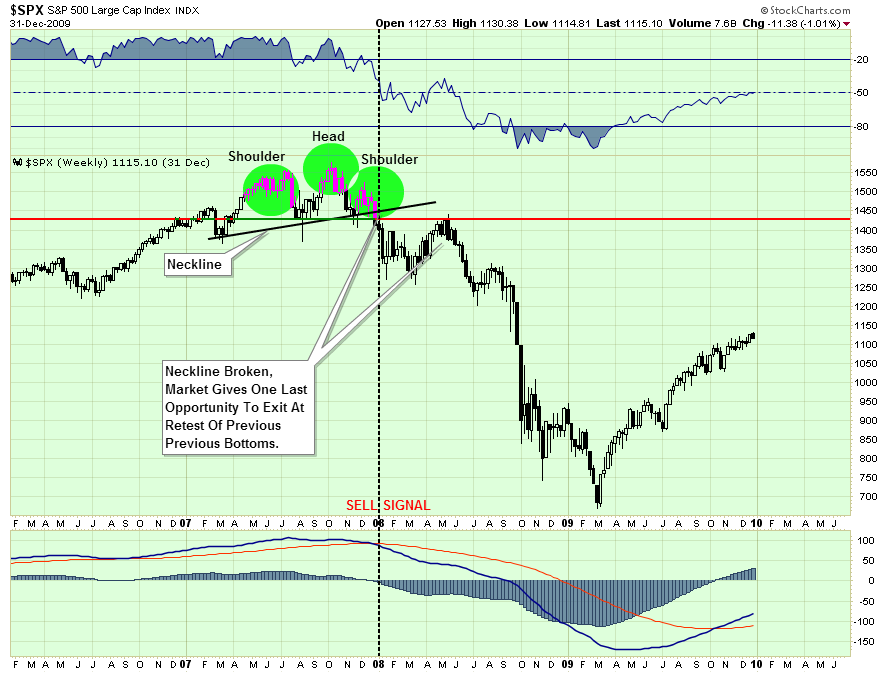

However, this isn’t the first time that we have seen a “head and shoulders” topping pattern form COMBINED with a long-term major sell signal as shown above. I emphasize this point because many short-term technicians point out “head and shoulders” formations that consistently do not lead to more important declines. However, when this topping process combines with enough deterioration in the markets to issue long-term “sell signals,” it is something worth paying attention to.

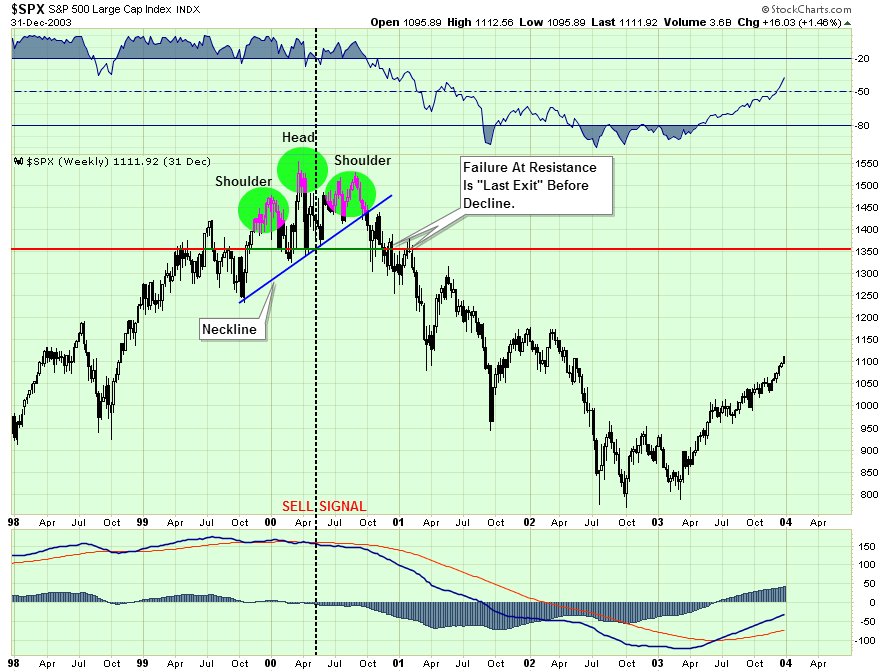

The first chart shows the same development in 2000.

And again in 2007.

These are the only two points since the turn of the century where a topping process was combined with a long-term sell signal.

It is important to note that in both previous cases the markets did provide one last chance to exit before a more substantiative decline ensued. This is because by the time the market has declined enough to break the neckline, sellers have been temporarily exhausted. This allows the market to rise enough to test previous resistance where “sellers” once again emerge.

It is very likely that if, or when, the market breaks current neckline support, individuals will be given one last chance to exit the markets for safer ground. A failure to do so has previously been the start of the “trail of tears.”

Predicting or Paying Attention?

Last night I gave a presentation to a group of doctors discussing the economy, the markets and what is most likely to come over the next few months.

One of the questions I was asked during the Q&A section was:

“How can you be so sure that you are right? No one can time the market?”

It is an interesting question, and one that I have been asked before. If you scroll down to the bottom of this report you will see a chart of the S&P 500 with the history of portfolio adjustments over time. You could call this timing, however, I prefer to call this risk management.

For me, “timing the market” is trying to be “all in” or “all out.” If you try and do that playing poker you are eventually going to go broke.

However, a good poker player understands the “risk of losing” given the particular hand that he is dealt. He will bet much heavier given a “full house” versus a “pair of deuces.” However, even given a great hand, a good poker player reads the other players at the table and adjusts his bets accordingly.

Leave A Comment