My Swing Trading Approach

I took profits in Caterpillar (CAT) for a +1.9% profit yesterday, while getting stopped out at the open in ROKU and PYPL. Currently I am short, and will gauge the market today for a potential bounce and quickly close my short position if need be. Either way, I expect to be very cautious in my trading approach in the market today.

Indicators

Sectors to Watch Today

Utilities were flat today, which isn’t unexpected considering the weakness in the overall market. Financials continues to struggle to provide any real direction going forward. Has been sideways since March. Telecom continues to trade well in a rising channel with support at the 50-day moving average. Staples had a major breakdown yesterday and confirmed a head and shoulders pattern too. Discretionary in a full-fledged breakdown and testing the 200-day moving average. Very bearish. Technology also breaking down, taking out its September lows.

My Market Sentiment

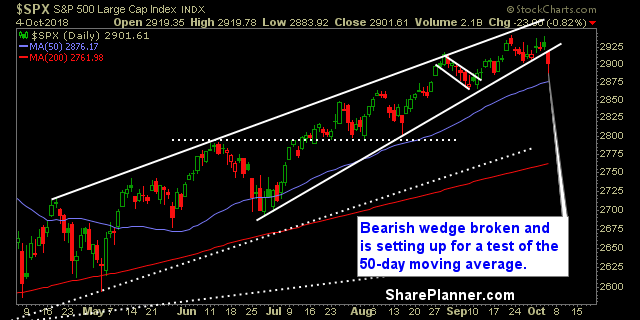

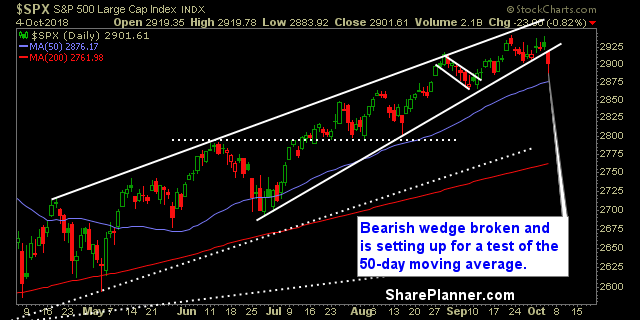

Bearish wedge chart pattern confirmed to the downside. Close to testing the 50-day moving average. SPX gave up its gains from September. Jobs number is weighing on the market today and could create further volatility as the day unfolds.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment