Bed Bath & Beyond Inc. (BBBY – Free Report) just released its third-quarter fiscal 2017 financial results, posting earnings of 44 cents per share and revenues of $3 billion.

Currently, BBBY is a Zacks Rank #4 (Sell) and is down 2.32% to $24.00 per share in after-hours trading shortly after its earnings report was released.

Bed Bath & Beyond:

Beat earnings estimates. The company posted earnings of $0.44 per share, beating the Zacks Consensus Estimate of $0.36.

Beat revenue estimates. The company saw revenue figures of $3.0 billion, topping our consensus estimate $2.90 billion.

Total revenues were relatively flat year-over-year. Comparable-store sales increased about 0.3%. Comps from customer-facing digital channels “continued to have strong growth,” while comps from stores “decline in the low-single-digit percentage range.”

The company declared a quarterly dividend of $.15 per share, to be paid on April 17 to shareholders of record at the close of business on March 16. Management also said that its full-year earnings guidance of $3.00 per share has not changed.

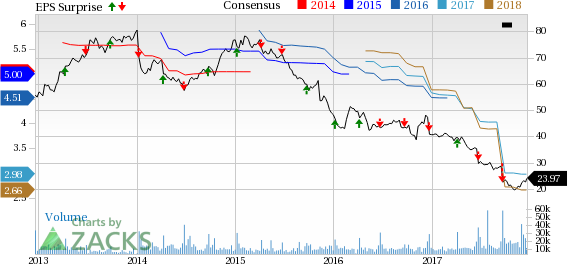

Here’s a graph that looks at Bed Bath & Beyond’s earnings surprise history:

Bed Bath & Beyond Inc. Price, Consensus and EPS Surprise

Bed Bath & Beyond Inc. Price, Consensus and EPS Surprise | Bed Bath & Beyond Inc. Quote

Bed Bath & Beyond Inc. is a retailer offering a wide selection of domestics merchandise and home furnishings. The company operates a robust e-commerce platform consisting of various websites and applications. The company also operates an established retail store base under the names of Bed Bath & Beyond, Christmas Tree Shops, Harmon, Harmon Face Values or Face Values, buybuy BABY, World Market, Cost Plus World Market or Cost Plus.

Leave A Comment