Between commodity-backed financing deals and the centrally-planned mal-investment boom-driven excess capacity, China has a lot of ‘liquidation’ to do to normalize from a credit-fueled smoke-and-mirrors world to a painful reality. As Bloomberg notes, there’s no let-up in the onslaught of commodities from China. While the country’s total exports are slowing in dollar terms (as we noted last night), shipments of steel, oil products and aluminum are reaching for new highs, flooding the world with unwanted inventories. China’s de-glutting is now the rest of the world’s problem as the deflationary tsunami grows ever higher.

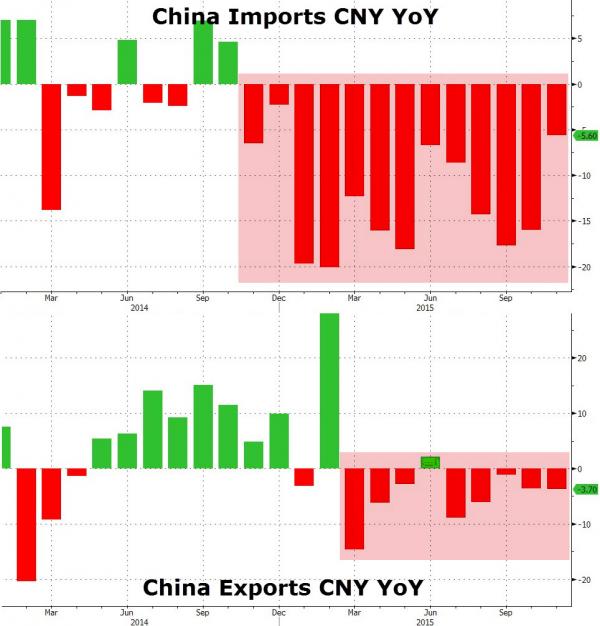

Chinese trade data was ugly with exports down 5 straight months…

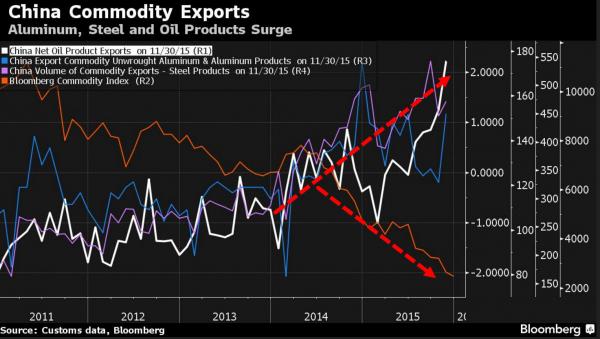

As Bloomberg notes, shipments of steel, oil products and aluminum are reaching for new highs, according to trade data from the General Administration of Customs.

That’s because mills, smelters and refiners are producing more than they need amid slowing domestic demand, and shipping the excess overseas.

The flood is compounding a worldwide surplus of commodities that’s driven returns from raw materials to the lowest since 1999, threatening producers from India to Pennsylvania and aggravating trade disputes. While companies such as India’s JSW Steel Ltd. decry cheap exports as unfair, China says the overcapacity is a global problem.

The flood of Chinese supplies is roiling manufacturers around the world and exacerbating trade frictions. The steel market is being overwhelmed with metal from China’s government-owned and state-supported producers, a collection of industry associations have said. The nine groups, including Eurofer and the American Iron and Steel Institute, said there is almost 700 million tons of excess capacity around the world, with the Asian nation contributing as much as 425 million tons.

Low-cost supply from China in Europe prompted producer ArcelorMittal to reduce its profit forecast and suspend its dividend. India’s government has signaled it’s planning more curbs on steel imports while regulators in the U.S. are planning to lift levies on shipments from some Chinese companies.

Leave A Comment