As we begin a New Year, I want to share with you the five most popular Frank Talk posts of 2017. One common theme you’ll see in these posts is they all center on the topic of gold. Although we specialize in educating investors about gold and managing gold funds, it’s worth noting that our gold posts garnered more interest than our bitcoin and blockchain posts in this year of cryptocurrency craze.

Cryptocurrencies hogged the spotlight in 2017, and some might say this attention drove investors away from traditional assets such as gold; however, I disagree, as I believe gold and bitcoin serve different purposes. While many might think gold underperformed in 2017, it actually finished the year strong. The precious metal ended the year up approximately 13 percent.

2017 In Review: The Top 5 Posts

1. 5 Things You Need to Know from last Week (Look What Gold Just Did!)

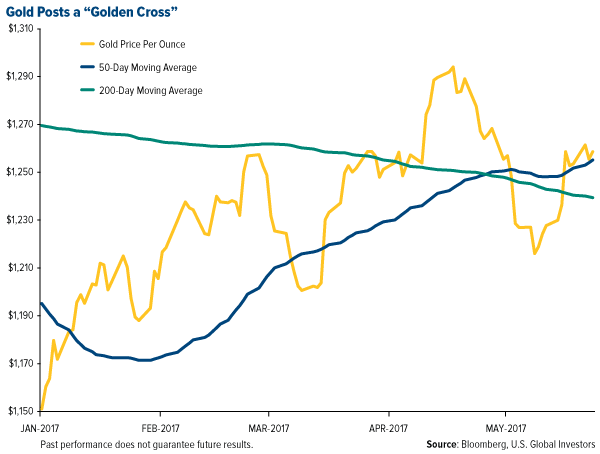

The last week of May was particularly bullish for gold after a “golden cross”—the 50-day moving average climbing above the 200-day moving average—occurred for the first time in over a year. A report released that same week from the Wall Street Journal confirmed my suspicion that Wall Street is run by quantitative analysts, or quants, whereby traders and fund managers make their instincts based on oceans of data rather than gut instinct. Other highlights from the week included the U.S. bouncing back as the top wheat producer and bitcoin trading around $2,700, double that of an ounce of gold. (By the end of this year, bitcoin, of course, hit a peak of over $19,000 then lost 30 percent of its value shortly thereafter.)

2. “Mother of All Bubbles” Keeps Gold in Focus

While many write of the potential bubble of bitcoin, I wrote earlier this year of the “mother of all bubbles”: total global debt. Global debt levels are rising each year with the U.S. alone adding $3 trillion every year to the pension deficit. People are living longer while near-zero interest rates are encouraging heavy levels of borrowing. In preparation for a possible burst, investors might consider placing some of their wealth in a hard asset such as gold.

Leave A Comment