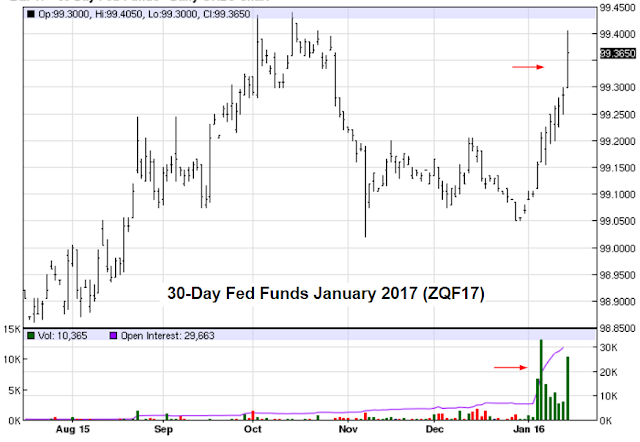

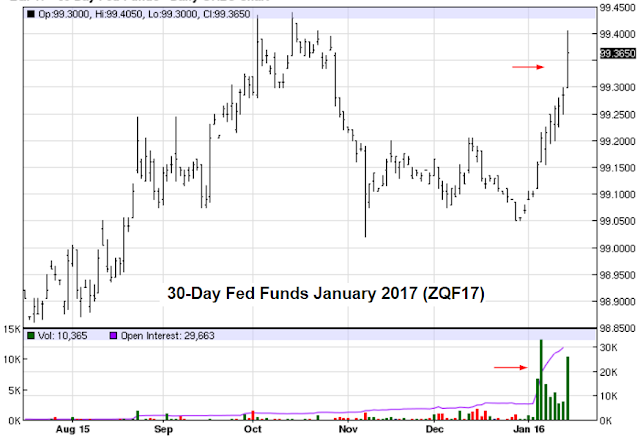

Continuing with our earlier discussion, betting against the FOMC’s dot plot accelerated on Friday, as the Fed Funds futures spiked. With the equity markets and crude oil pummeled (as deflationary risks rise again), the January 2016 contract trading volume shot to new highs, with the contract price rising sharply (implied Fed Funds rate fell).

Source: barchart

Source: Investing.com

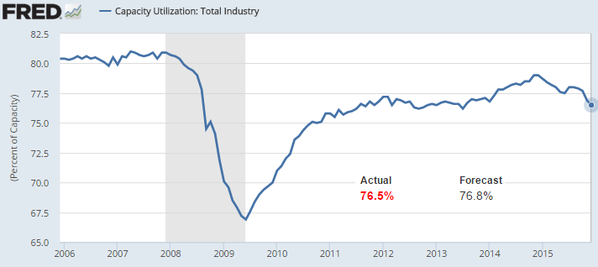

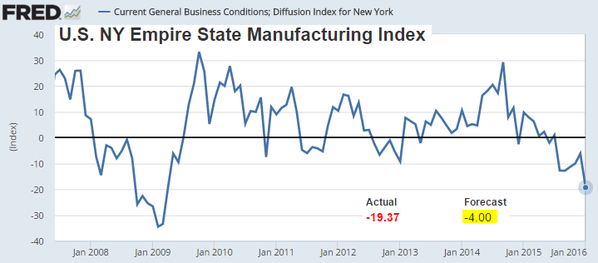

Bets against the FOMC’s forecast gained momentum after significantly worse-than-expected US industrial production and NY manufacturing reports. In fact the NY Fed manufacturing figure was so bad, many initially thought it was an error. Welcome to the world of strong US dollar …

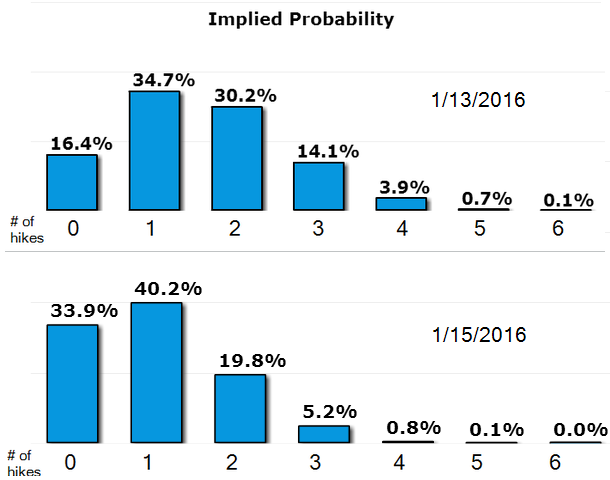

As a result, the implied probability of 4 (or greater) rate hikes in 2016 (as predicted by the dot plot) dropped from 4.7% on Wednesday to under 1% on Friday. On the other hand, the probability of no hikes this year doubled in just two days.

Source: CME

This has significant implications for the US dollar and risk assets. If the Fed is indeed on hold for some time, with possibly just one hike this year (if that), we should see the dollar come under pressure and commodity prices stabilize.

Leave A Comment