For investors looking for high-quality dividend stocks, the Dividend Aristocrats is a great place to begin your research. The Dividend Aristocrats Excel spreadsheet has 51 stocks with 25+ consecutive years of dividend increases.

Health care giants Johnson & Johnson (JNJ) and Medtronic (MDT) are both on the list. J&J is a member of an even more exclusive club: the Dividend Kings. It has increased its dividend for 55 years in a row, compared with 40 years for Medtronic. The Dividend Kings Excel spreadsheet has just 19 stocks, each with 50+ years of consecutive dividend increases.

This article will attempt to find out which of these two Dividend Aristocrats is the better buy right now.

Business Overview

Winner: J&J

Both J&J and Medtronic are highly profitable companies, with leadership positions in their respective industries.

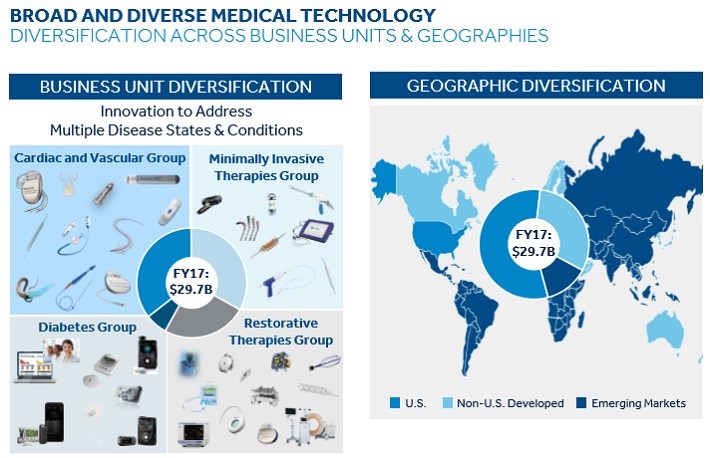

Medtronic is a global medical devices giant.

Source: 2017 Bernstein Annual Strategic Decisions Conference, page 4

There is some overlap between them. J&J also has a large medical devices business of its own. The main difference between the two companies, is that J&J is much more diversified. In addition to its medical devices segment, it also operates huge pharmaceuticals and consumer healthcare businesses.

Source: 2016 Earnings Presentation, page 1

This gives J&J a structural advantage, which may be more attractive to investors looking for steadier growth. J&J’s diversification gives it more consistent growth.

Medtronic performed well in fiscal 2017, with 5% organic revenue growth for the full fiscal year. Adjusted earnings-per-share increased 11%, to $4.60. All four of Medtronic’s businesses generated growth, led by 4% organic growth in the Minimally Invasive Therapies Group and Diabetes Group. Last year’s performance was highly impressive, although, in fiscal 2016, Medtronic’s adjusted earnings-per-share increased just 2%.

Leave A Comment