Kinder Morgan (KMI) and Enterprise Products (EPD) are two of the biggest oil and gas transportation companies in the U.S.

Both companies operate in the midstream segment, which means their assets are comprised mainly of oil and gas pipelines and terminals.

However, they are very different in terms of dividends.

In December 2015, Kinder Morgan cut its dividend by 75%.

It had an over-leveraged balance sheet, and when commodity prices crashed, decided to cut its shareholder payout to pay down debt.

Enterprise Products has raised its distribution 59 times since its initial public offering in 1998.

It has also increased its dividend for 50 quarters in a row, a streak going back 12 years.

As a result, Enterprise Products is a Dividend Achiever, a group of 271 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

This article will discuss which of the two infrastructure giants is the better investment today.

Business Overview

Winner: Kinder Morgan

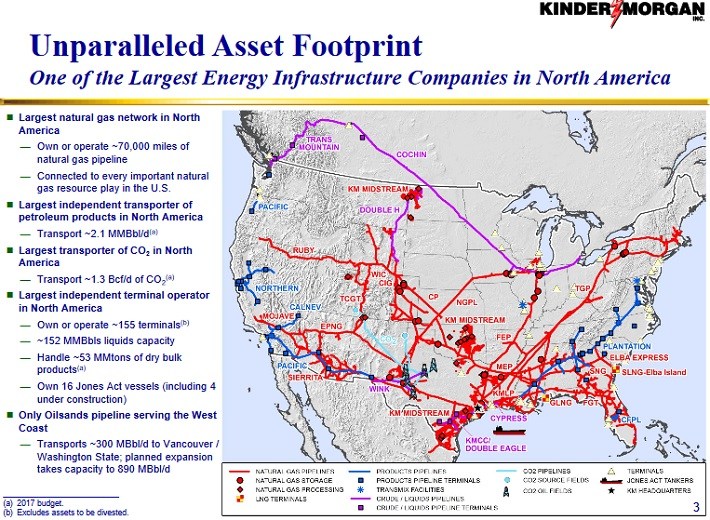

Kinder Morgan is the largest energy infrastructure company in the U.S., with 84,000 miles of pipelines and 155 terminals.

It also has the largest natural gas network in the U.S.

Source: Barclays IG Energy and Pipeline Conference, page 3

The two companies both have access to the premier oil and gas producing fields in the U.S., and they operate similar business models.

As pipeline and terminal operators, Kinder Morgan and Enterprise Products are essentially toll roads. They collect fees based on volumes being transported through their systems.

Enterprise Products operates 49,000 miles of pipelines, with over 400 miles of pipelines under construction.

Source: March Analyst Conference, page 8

This fee-based structure provides stability, and less exposure to commodity prices.

One difference between the two companies is that Enterprise Products is an MLP, while Kinder Morgan is a C-Corp.

Leave A Comment