What effect will Fed balance sheet normalization have on Treasury yields?

That’s quickly becoming something of an obsession for market participants and rightfully so.

After all, no one (least of all the Fed itself) has any idea how this is going to work or how it will impact markets.

This situation is complicated immeasurably by concurrent tightening from other DM central banks and from factors outside of developed markets including, most notably, the ambiguity created by the reversal of EM reserve accumulation.

That latter dynamic (the end of the “great accumulation” as Deutsche Bank dubbed it some two years ago) became the subject of heated debate in 2015 as GCC countries weighed how to plug budget gaps and defend currency pegs in the face of falling oil prices and China liquidated its reserves to control the pace of the yuan deval.

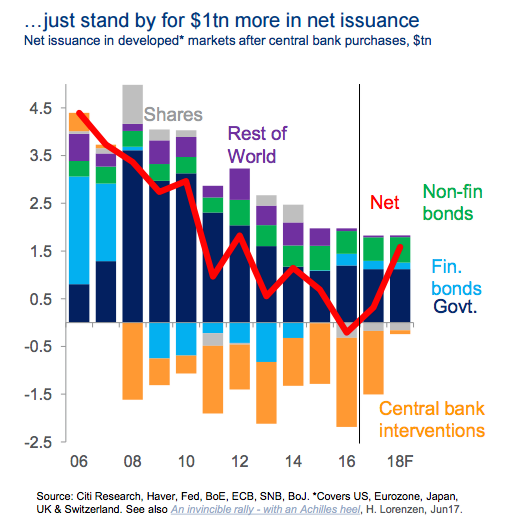

If the post-crisis era has been characterized by voracious demand for DM debt by price insensitive buyers, then the rolling back of crisis-era policies will be characterized by the opposite. It will, simply put, fall to price sensitive buyers to absorb supply. So it isn’t just that tapering will by its very nature put upward pressure on yields, it’s that the folks who step in to replace central banks on the demand side of the equation will be rational investors where “rational” means their propensity to absorb supply will depend on the attractiveness of the investment. This represents a complete shift in the dynamic.

In short: Fed balance sheet normalization won’t happen in a vacuum.

This is something Citi has discussed at length and it’s illustrated simply in the following chart:

On Tuesday, Citi’s Harvinder Sian is out with an in-depth look at what’s in store and his analysis is pretty interesting.

First, Sian notes that central banks have effectively taken half the burden of absorbing budget deficits off the private sector’s shoulders:

Leave A Comment