Traditional Markets

The White House has named a replacement for its top economic advisor Gary Cohn who quit abruptly last week.

Larry Kudlow is the former Chief Economist of the famous Bear Stearns, whose demise a decade ago set off the financial crisis of 2008. Kudlow, of course, got out many years before that and has spent much of his career since as a television personality on CNBC.

Though Kudlow is expected to be a more of a Trump loyalist, he’s already contradicted the President on the position of the US Dollar. In fact, even before the Senate Hearing confirmations have begun he’s already given us a hot trading tip…

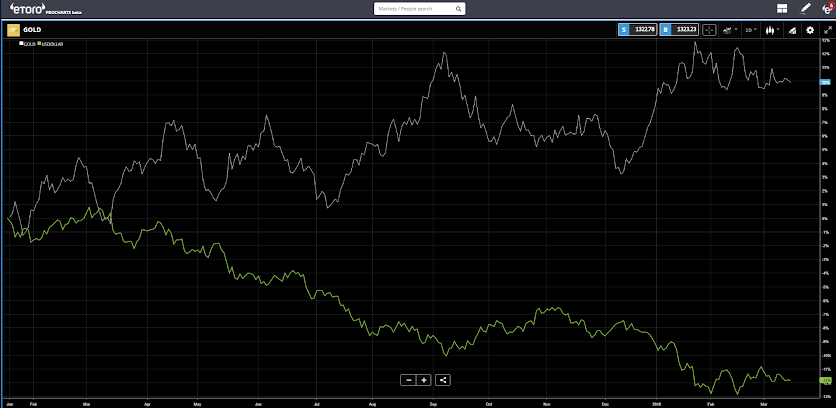

Given the divergence between these two assets since the beginning of Trump’s term, I would say that if the trends reverse this could actually work out really well on many portfolios.

This graph shows Gold (in white) rising steadily, while the Dollar (green) is falling hard. This type of divergence can be a real opportunity for those who know how to size it.

Bye Bye Franky

Another thing that seemed to slip under the radar of international media scrutiny was the Senate’s overwhelming approval for a partial repeal of Dodd-Frank. If passed by Congress, this bill proposed by Mike Crapo will drastically ease the restrictions on banks from becoming too big to fail.

Proponents claim that the harsh rules imposed on banks in the wake of the financial crisis were stifling the banks’ ability to raise capital. Opponents say that this was the exact intention.

Crypto Hearing

To say that the Crypto Congressional hearing yesterday didn’t go as well as was expected is a vast understatement. According to CNBC…

That’s not to say there weren’t some bright spots. Representative Tom Emmer came out in favor of a lighter touch by regulators and calling for greater balance, somewhere between the current “wild west” state and total annihilation.

Leave A Comment