Is the world’s richest man starting to get a little concerned that his $90 billion fortune in Amazon stock might just be fully valued? Well, judging by his SEC disclosures from last Friday, Bezos provided investors with roughly 1.1 billion reasons why the answer to that question may be a resounding ‘yes’.

As Bloomberg points out, Bezos sold a total of 1 million Amazon shares over the course of three days last week netting roughly $1.1 billion in proceeds. The sale represented just 1.3% of Bezos’ total stake in Amazon and leaves him with 16.4% of the company’s shares outstanding.

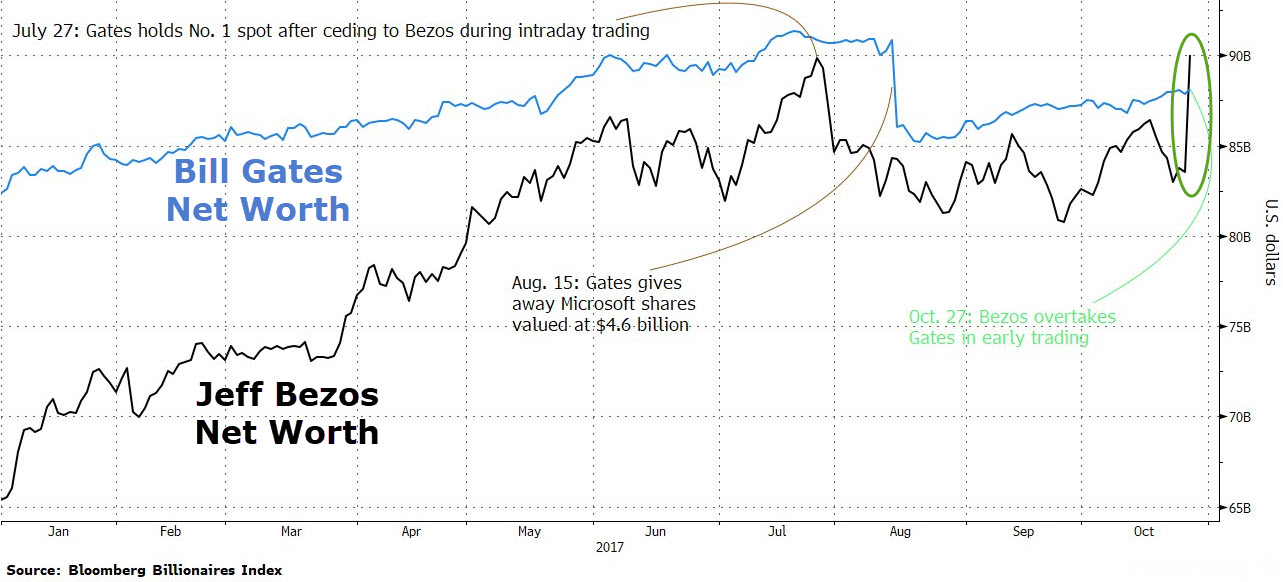

Of course, the stock sales came after Amazon beat earnings estimates the week prior (see: Amazon Soars Above $1,000 After Smashing Expectations) and pushed the stock to new all-time highs.As an added benefit, the move also once again thrust Bezos ahead of Bill Gates on the Billionaire leader board.

Of course, Bezos previously reported that he would sell $1 billion a year in Amazon stock to fund his Blue Origin LLC, the rocket company fueling his dream of sending people into space.That said, this was Bezos’ second $1 billion sale in a matter of 6 months so perhaps Blue Origin just needed a little extra cash this year?

Then again, maybe this is just ‘tax planning’ or ‘diversification’ or any of the many other excuses executives give for selling their own stock…certainly it has nothing to do with Amazon’s 282x P/E ratio…

Leave A Comment