Economic Reports Scorecard – 10/24/15 to 11/6/15

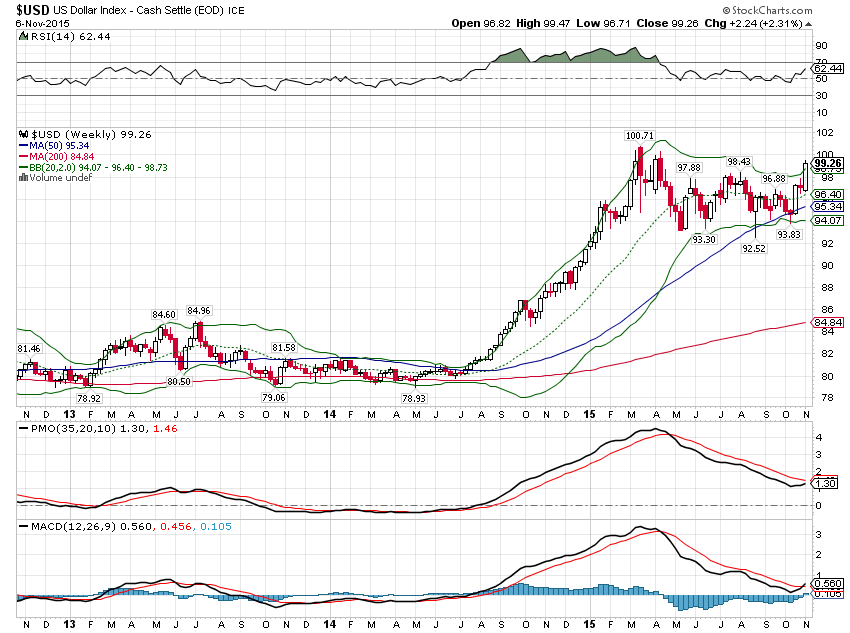

The economic data of the last two weeks stands in fairly sharp contrast to the markets’ movements. Markets, particularly bonds and gold, are going all in, betting that this time Yellen & Co. have it right, that growth is really about to accelerate this time. From the end of the last FOMC meeting to the employment report last Friday, the 10 year Treasury yield jumped 30 basis points while gold fell $75 over 9 straight down days. The US dollar index rose more than 2% and is nearing the high set in the spring of this year. The move in stocks hasn’t been as dramatic but still the S&P 500 is up about 1.5% since the Fed took a more hawkish stance on interest rates.

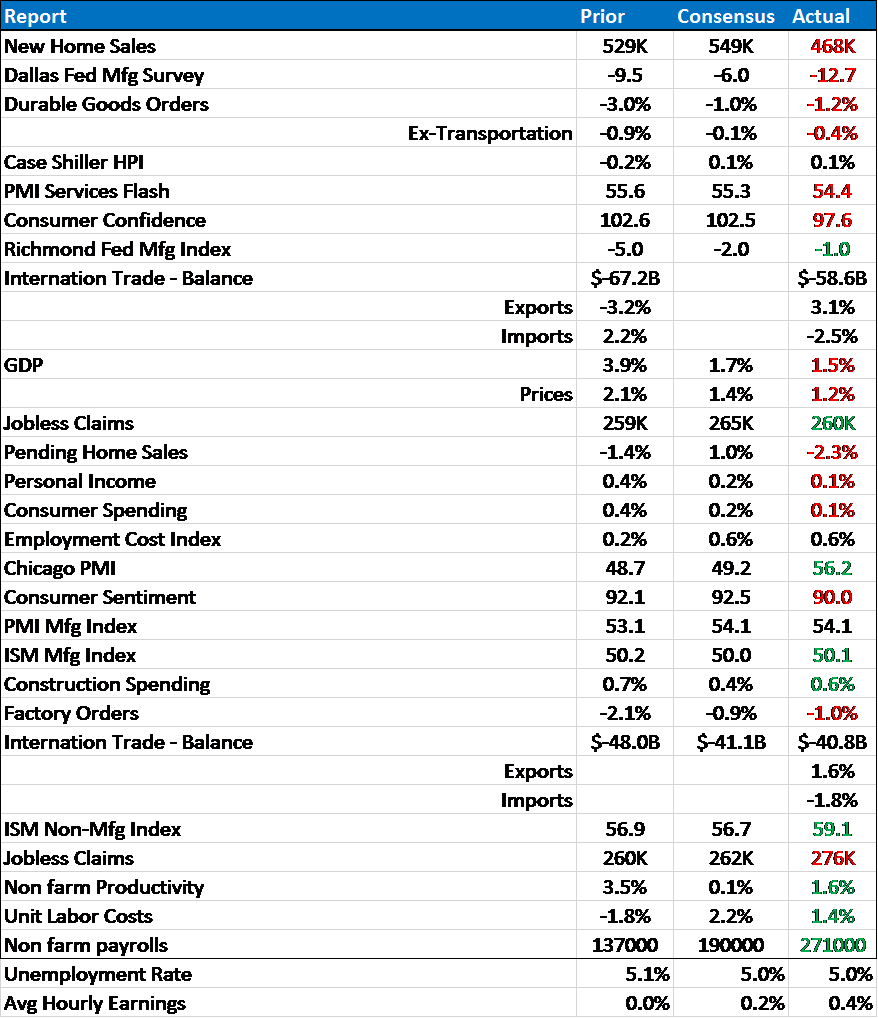

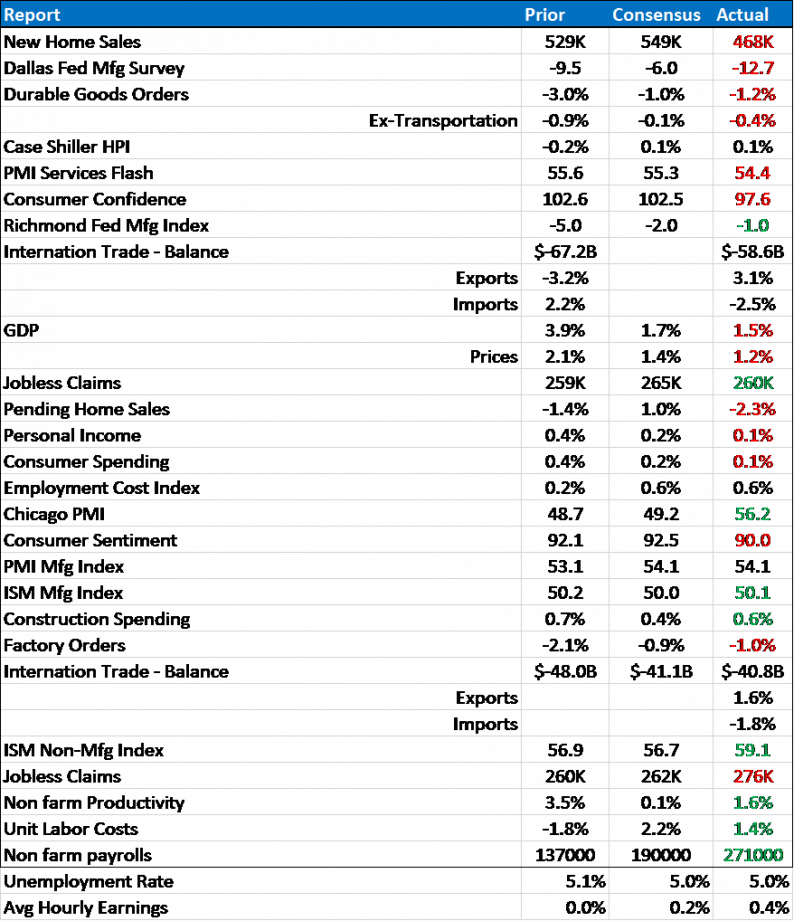

These moves are powerful indicators of the market’s anticipation of higher growth. It is disconcerting though to see that the moves have been almost entirely a result of Fedspeak rather than actual economic data. The data from the last two weeks, if anything, continued to deteriorate. There were some positive reports along the way but overall the ratio of positive to negative surprises favored the denominator by slightly less than 2 to 1. The divergence between the industrial/manufacturing side of the economy and the service side continued. Most of the Fed manufacturing surveys showed contraction, durable goods orders fell again as factory orders disappointed and while the ISM was a slight beat, it came in just above the contraction line at 50.1.

The trade report showed a small rebound in exports but the drop in imports is concerning. That isn’t a sign of strength but rather what we see around every recession; it indicates weak domestic demand. Yes, some of that was due to oil prices but that story is getting long in the tooth – low oil prices isn’t news anymore. Construction spending was higher but in general the news on real estate was worrying with both new and pending home sales disappointing and falling. Real estate and autos – which are selling at over an 18 million annual rate – have been the leaders of the economy since the manufacturing/shale slowdown started. To see one potentially stumble is or should be concerning.

Leave A Comment