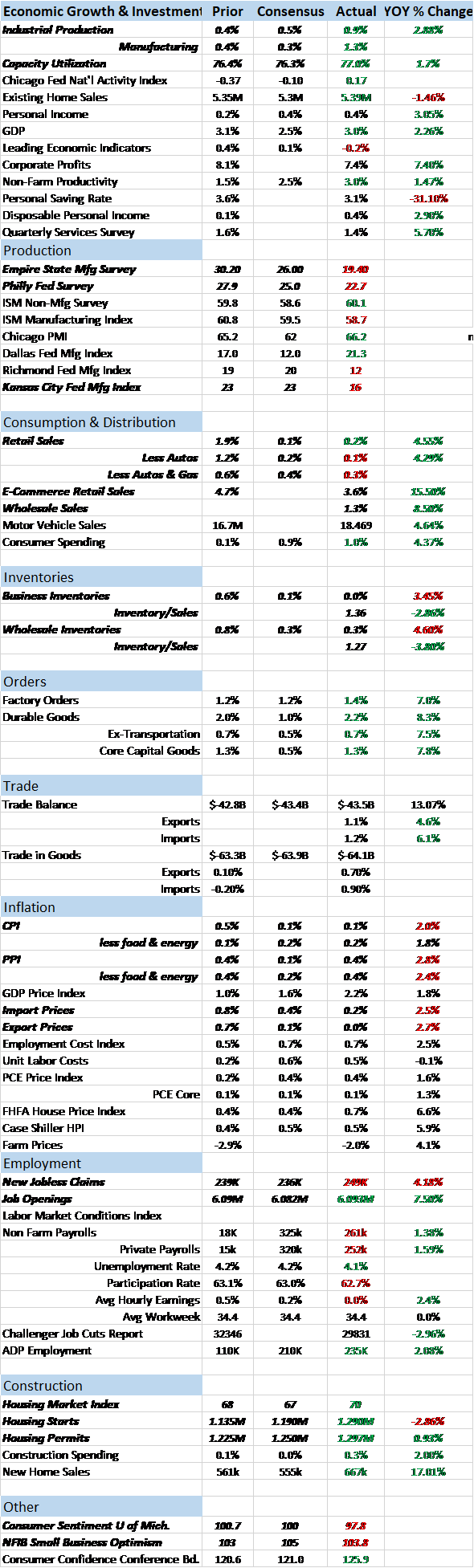

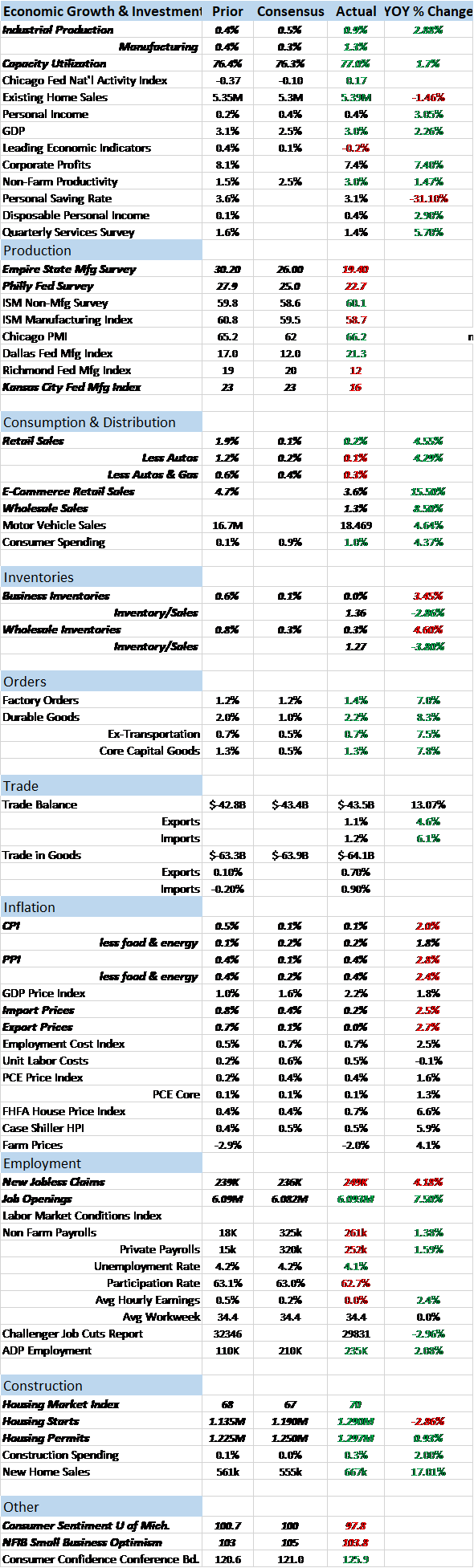

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had more than its fair share of ups and downs but these mini up and down cycles within the larger cycle are nothing unusual. We are now in an up cycle and the data reflects that. But context is everything and as I keep saying with every one of these reports, not much has changed.

This mini up cycle has been extended by the bounce back from the two hurricanes that hit earlier in the fall. How much of the recently better data is due to hurricane effects? I don’t know of any way to quantify it but when in doubt I always fall back on market-based indicators. As I discussed in the update two weeks ago, the stock market is anticipating a future so bright we’ll have to all wear rose-colored glasses so ignore that for a minute. All the other indicators we watch are not nearly as exuberant about the prospects for a sustained upturn in growth. The Fed may welcome the better data to justify their preferred course of action but evidence of a robust economy is hard to find outside the stock market.

The best indicator of future growth is the yield curve. That is backed up by a plethora of research and historic observation. And today it is telling us the same thing it has been telling us for the last several years. The spread between 10 year and 2 year Treasury note yields continued to fall since the last update, now at 62 basis points. That is a 9 basis point fall in two weeks and the curve is now at its flattest of this cycle. That doesn’t mean we are on the verge of recession, just that we are moving through the business cycle, drawing closer to its inevitable end. It also seems to be saying that either the tax cuts being much debated will not happen or worse that they will have no positive impact.

Leave A Comment