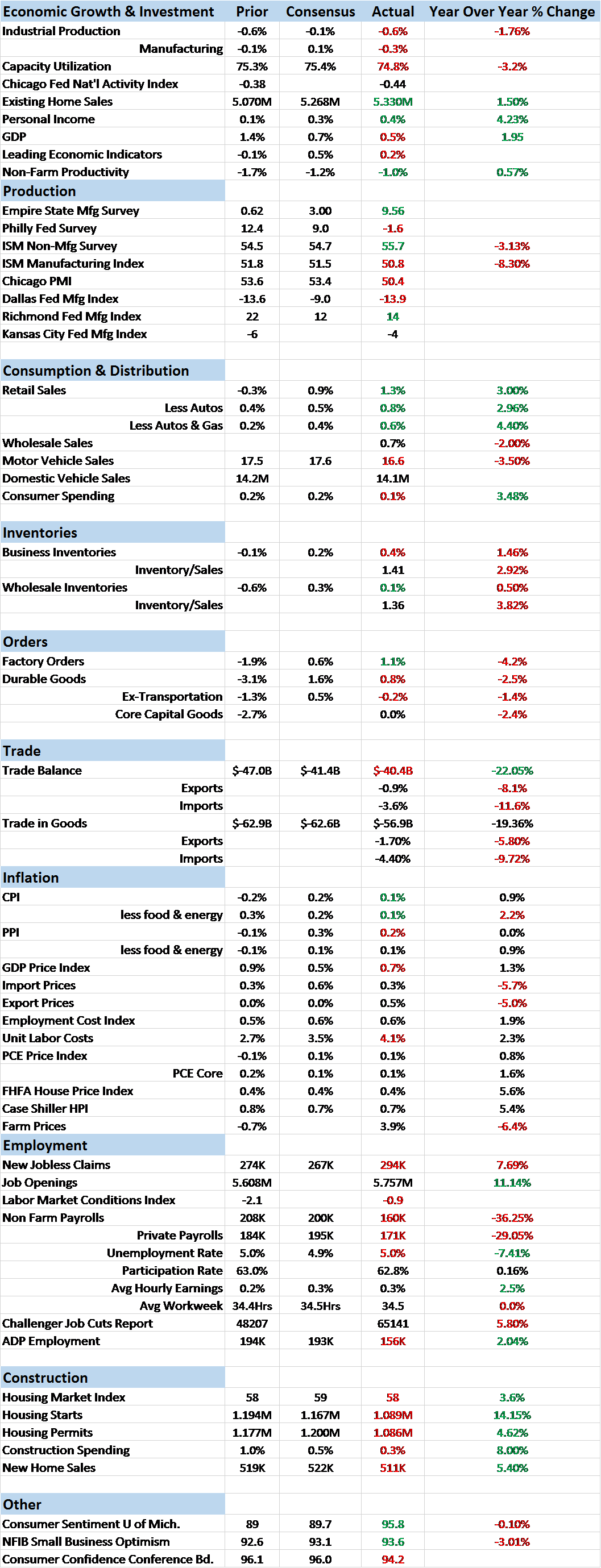

Economic Reports Scorecard

The tone of the economic reports improved over the last two weeks with quite a few releases coming in better than expected. From a scorecard viewpoint, we had 6 reports better than expected versus 8 worse than expected for the reports where a consensus can be tracked and interpreted. (Note: sometimes it is hard to classify a report as “better” or “worse”. For instance, is a rise in inventories positive or negative? Depends on why of course. So I exclude reports like that in coming up with a count.) Unfortunately, I’d classify the misses as more important that the hits. A miss on the employment number, even though it is backward looking, is more important than a beat on the ISM non-manufacturing index, at least when it comes to the markets.

Of the better than expected reports, I’d have to say the most positive was the retail sales report we got just this morning. It wasn’t much of a surprise – or shouldn’t have been – since we already knew that auto sales rebounded in the month but the strength does appear pretty broad based. Every category was higher except building materials and garden equipment. Other standouts were consumer sentiment which rebounded strongly on rising expectations and the JOLTS report which showed rising job openings. One caveat to the positive reports though is that many of the positives were either sentiment based – which tend to be coincidental – or lagging indicators like retail sales.

On the negative side the most prominent reports were employment related, somewhat contradicting the positive JOLTS report. Jobless claims ticked higher both weeks by considerable amounts and are now approaching the 300k threshold. A trend change here would not bode well for stocks since claims have inversely tracked the stock market for a number of years (that hasn’t always been the case). The labor market conditions index also continues in negative territory although with a slight improvement over last month. And of course the employment report itself was soft with the participation rate falling back after a brief rally.

Leave A Comment