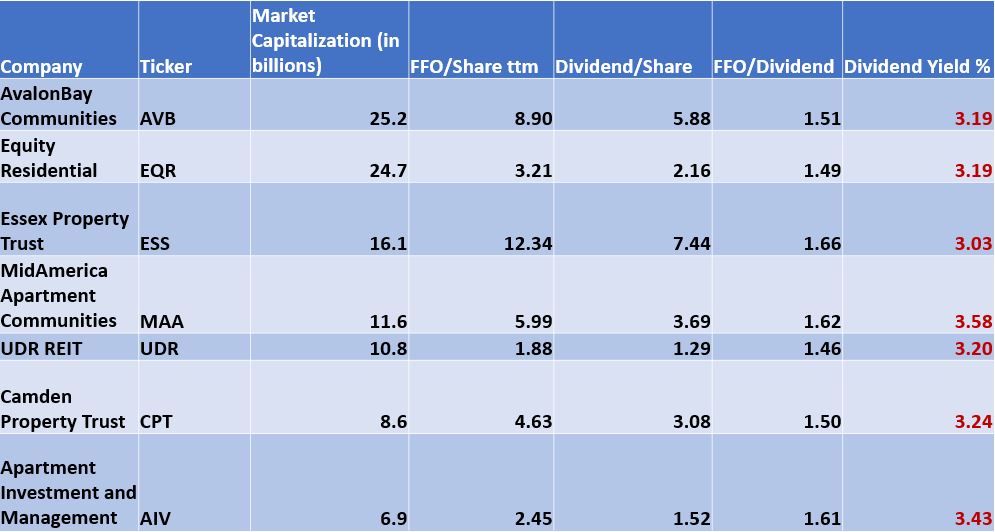

The six largest publicly traded apartment REITs are now paying dividend yields of less than 3.5%. The two largest — AvalonBay Communities and Equity Residential — are paying around 3.2%. Essex Property Trust, whose apartment buildings are all in California, is paying barely over 3%, roughly the equivalent of the 10-year U.S. Treasury Note. Historically, REITs have paid one full percentage point more of yield than the 10-year Note, and that means investors in apartments could be in for trouble if the yield on the 10-year Note doesn’t decline and/or the apartment landlords don’t increase their dividends.

Recent History of Apartment REITs

Among the different property types in real estate, apartments (sometimes called the “multifamily” sector) have done particularly well since the financial crisis. That makes some sense since homeownership went from the low 60% range to above 68% during the bubble period of 2003-2007, and the collapsed again to the low 60% range. Families that couldn’t stay in homes after the crisis went back to renting. Also, multifamily new development stagnated, and a continued influx of educated people into big cities with limited apartment stock contributed to increasing rents.

At around the beginning of 2011, companies like AvalonBay Communities and Equity Residential, the two largest multifamily REITs, and their competitors began raising rents, and haven’t stopped since. In the early years of the recovery, those rent increases were sometimes more than 6% on a year-over-year basis. After a dip in the rate of increase in 2013-2014 to the high 3% range, rent increases moved up to nearly 6% again in late 2015 and 2016.

After declining down to 2%, rent growth has picked up for the past few quarters again. But publicly traded multifamily companies are increasing rent in the 2%-3% range on a year-over-year basis instead of the 6% range. The pattern for Avalon Bay is similar to those of its competitors.

Leave A Comment