Financial sector stocks have significantly outperformed since the US election last month. The narrative has been that the president-elect’s pro-growth agenda, and anticipated rollback of regulations, will benefit banking stocks in particular. However, business development companies (BDCs) are also part of the financial sector, and market conditions may be increasingly stacking against them, yet their prices have also outperformed since the election, and this is in addition to their already very strong performance earlier this year leading into the election. This article reviews some of the big risks facing the BDC industry, and provides some ideas on how income-focused investors might safely invest in BDCs.

The Big Risks:

Less Regulation:

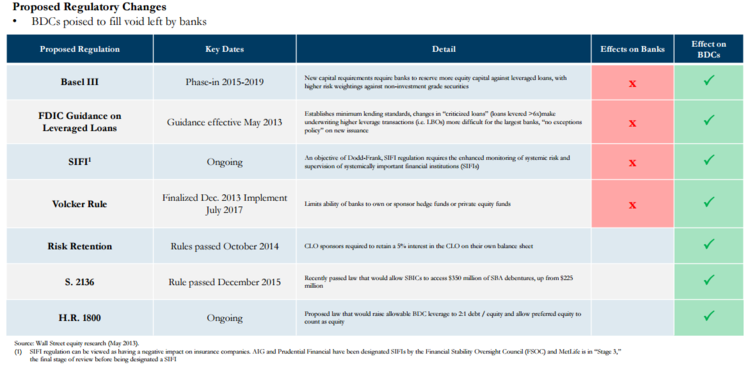

The first big risk is that government may rollback regulations in the banking industry, which could actually create more competition and less opportunities for BDCs. The narrative (and reality) for BDCs over the last 5 years has been that they’ve benefitted from de-risking in the banking industry. Specifically, big banks have been required (by regulations) to de-risk their balance sheets and purge high risk investments. In essence, this has meant less higher risk middle market lending for banks, and that has created the opportunity for business development companies as shown in the following graphic (note: the table is from 2013 when the Obama Administration was in full force, and long before Donald Trump was ever expected to win the Presidency).

The key point is that regulations have been hurting banks and helping BDCs, but that could all be about to change under the new administration.

Higher Interest Rates:

The next big risk facing BDC’s is higher interest rates. Most BDCs have structured their investments so they will actually benefit from a rise in rates in much the same way big banks benefit when net interest margins increase. However, the risk is that higher interest rates may actually lead to higher defaults. If you are a middle market business with a floating rate loan from a BDC and that rate floats too high then you may fold (default) under the pressure. After all, low rates were intended to boost the economy and higher rates may work to slow the economy. And when the economy slows, BDCs are left holding some of the riskiest loans. For reference, these next two CME charts shows the market’s expectation of rising interest rates.

Leave A Comment