The US federal government on Monday reported its biggest budget deficit in February in six years. By some accounts, the news offers another reason for projecting that Washington’s red ink and inflationary pressures will heat up in the months and years ahead.

Some analysts warn that the tax cuts enacted last year will raise the government’s debt load in the years to come. One estimate projects that the reduction in tax rates will cut federal revenue in excess of $1 trillion over the next decade. There was a degree of support for that estimate in yesterday’s Treasury data, which reflected a 9% slide in revenue in February vs. the year-earlier month, in part because withholding taxes were 2% lower, MarketWatch reported. Meanwhile, spending linked to net interest on the public debt jumped 9%.

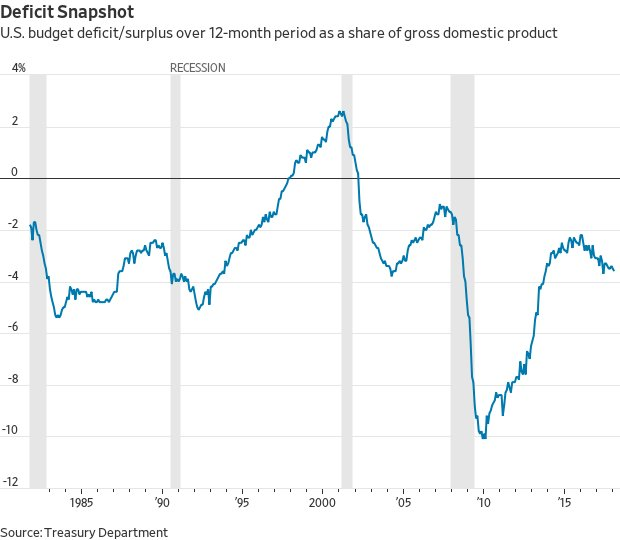

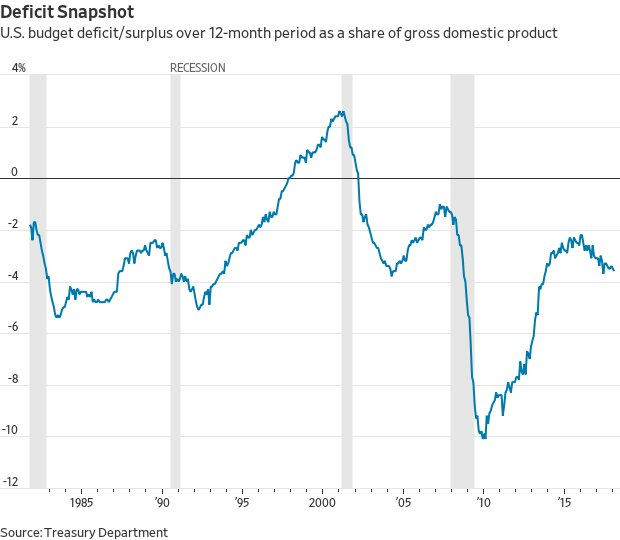

Nick Timiraos at The Wall Street Journal notes via Twitter that “over the 12 months ended February, (Donald Trump’s first full year in office), the federal budget deficit widened to $703 billion (3.6% of GDP), up from $583 billion (3.1% of GDP) over the prior 12-month period.”

The connection between deficits and inflation is debatable, although an economics note from the St. Louis Fed in 2004 advised:

Deficits can be a source of inflation if they are accommodated by monetary policy — that is, if the Federal Reserve responds to higher deficits by increasing the growth of money. The Federal Reserve has two ways of responding to higher deficits:

1. The central bank directly purchases the securities issued by the government to finance the deficits.

2. The private sector purchases these same securities; then, the central bank attempts to limit any potential interest rate increases.

Under either scenario, deficits lead to greater money base growth, which can create inflationary pressure.

It’s interesting to note that real year-over-year growth in base money has been rising in each of the past six months through January – at a time when the central bank’s monetary policy is said to be tightening. Is this a sign that hawkish turn in policy is less hawkish than generally assumed?

Leave A Comment