As the Fed’s third and last bubble of this century heads for its splatter spot, the stench of desperate crony capitalism fills the air. You can count hedge fund mogul and Billary Buddy, Marc Lasry, among the upchucking financiers.

A few months back I heard him say on bubble vision that energy debt was a “once in a lifetime opportunity”. My thought was good luck with that, but even better luck to your investors—who will need to get out of Dodge fast.

The truth is, Lasry had it upsidedown. Energy prices over the last 15 years were carried skyward by a once in a lifetime central bank driven credit explosion. The latter fueled a surge of phony demand and a tidal wave of malinvestment—not only in oil and gas, but practically everything else in the material and manufacturing economy of the world.

The reason that 2016 will prove to be a great historical inflection point is that the central banks of the world have finally run out of dry powder. After a 20 year spree in which their balance sheets exploded by nearly 11X—from $2 trillion to $21 trillion—they are being forced to shutdown their printing presses.

China has been obliged to stop because it has been slammed with a $1 trillion capital flight in the last year, and it’s accelerating. The BOJ and the ECB have already shot their wad and it’s done no good at all. The Fed spent 84 months dithering on the zero bound and now it has no dry powder left as the US economy slides into recession.

Accordingly, the great global credit bubble has finally run out of new central bank fuel. It has now surely reached its apogee at about $225 trillion compared to only $40 trillion back in 1994 when oil prices were still well under $20 per barrel. And soon the world’s mountain of debt will be falling in upon itself—starting with the cratering Red Ponzi of China.

Needless to say, the latter amounts to a sword of Damocles hanging over the world’s massively deformed and dangerously unbalanced energy markets. To wit, almost all of the increase in global oil demand since the 2008 crisis has been in China and its caravan of EM suppliers and fellow travelers.

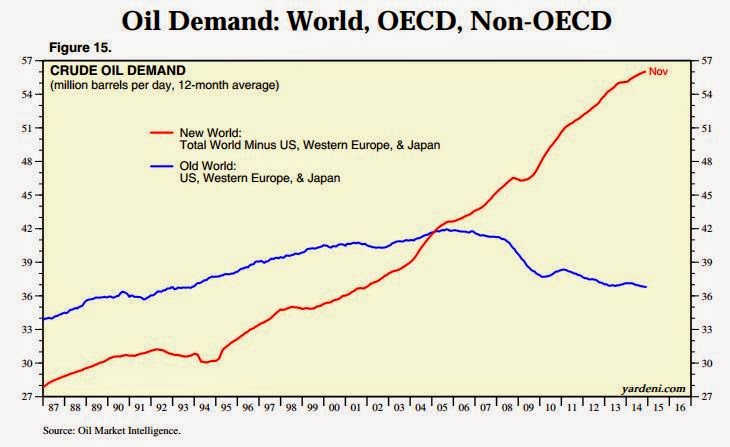

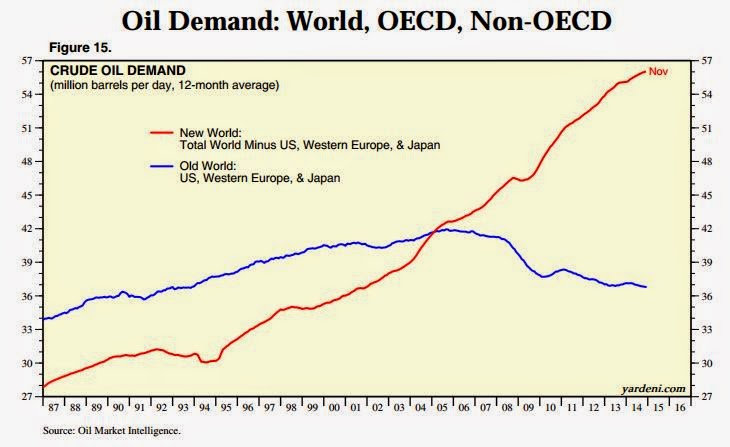

Total global demand in 2015, in fact, averaged about 92.6 mb/d per day (liquids basis)—up nearly 7.0 mb/d since 2008. But 4.0 mb/d of that growth was attributable to China and another 6.0 mb/d to Brazil, Korea, the petro-states and the balance of the EM economies. By contrast, oil demand in the US, Western Europe and Japan is actually down by about 3.0 mb/d since the 2008 peak, as shown below:

Now here’s the thing. While the red line above representing the Red Ponzi and its supply chain looks like it’s still slightly rising, it’s actually in the process of heading sharply southward. That means that in the period ahead, demand will be falling all across the planet on a sustained basis for the first time in modern history.

Moreover, that is not a forecast—it’s already happening. China’s apparent growth of 500k b/d last year was entirely due to filling its strategic reserve. But it has now run out of space—at the very same time that its oil-using industrial economy is falling out of bed.

In fact, rail freight volume last year plunged by 10%, meaning that even China’s working commercial petroleum stocks are overflowing. The same slide in demand is obviously occurring in Brazil and throughout the EM.

Leave A Comment