It is getting hot in the U.S. stock market, as new trends are developing going into the summer.

Our key theme in the last couple of weeks is that markets are currently trendless, as explained here and here. New trends are developing as we speak, but the market will take its time, so don’t try to anticipate markets, as that could be very costly.

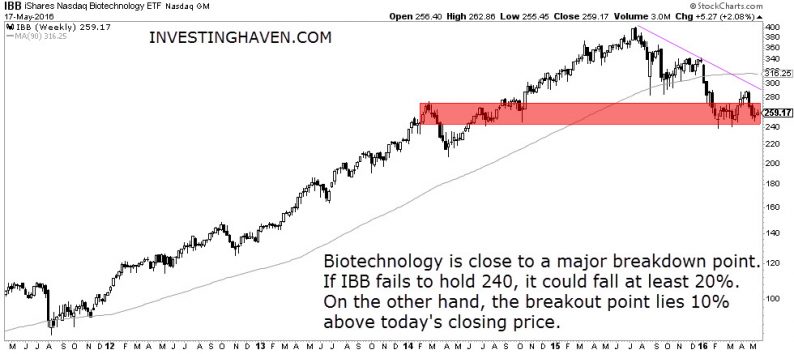

As markets are looking to develop new trends, some specific segments coming close to breakdown levels. One such example is biotechnology. The IBB chart, representing the biotech sector, is clearly close to breaking down. As seen on the chart, the index is currently trading at 259 points, which is some 7% points above the lower area of the breakdown level. A break below 240 will have a nasty outcome, as the index could easily fall to the 180 to 200 area.

On the other hand, as the purple trendline shows, the breakout point lies at 285 points, which is only 10% above today’s level.

In other words, both outcomes are still open. Investors and traders better wait for a confirmation (breakdown or breakout) before taking any position.

Leave A Comment