Bitcoin topped $10,000 on some exchanges yesterday to much fanfare and animal spirits internationally.

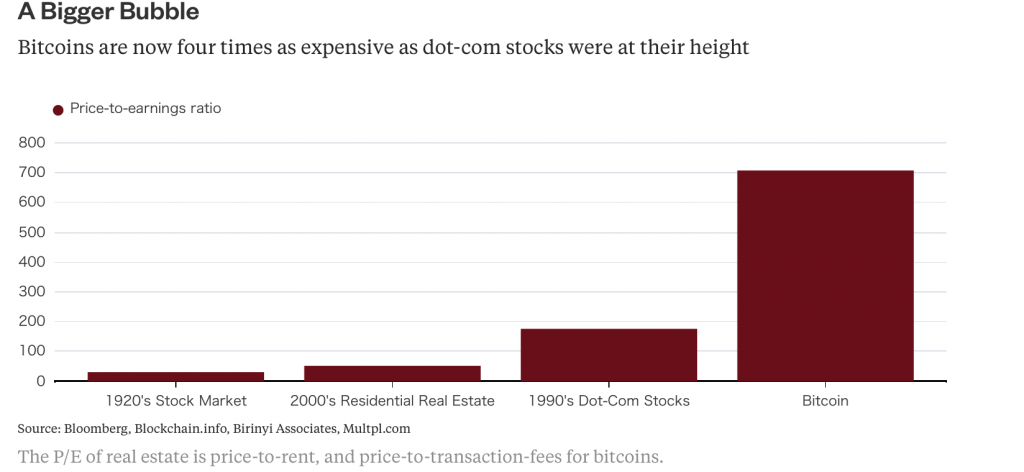

With an 850% surge in less than a year, bitcoin has seen gains that are four times more than dot-com stocks gains at their height in the late 1990s. This is making the first and arguably the best cryptocurrency look like it is an ever-growing bubble which will no doubt hurt many speculative punters when it finally goes ‘pop’.

Bitcoin’s market cap is over $160 billion and more than that of General Electric, a company that has been in existence since 1892 and has nearly 250,000 employees.

When you look on Google Trends and see the search for ‘Bitcoin Bubble’ reach a peak as the price probes $10,000 then you know that many owners and non owners of the cryptocurrency are beginning to get worried. Although a contrarian might say that the widespread concerns of a bubble mean that we may be in the early stages of the bubble.

Bitcoin has many factions concerned. Central bankers are worried about its impact on financial markets, merchants are confused if they should be accepting it or not, exchanges are terrified they’ll get a large sell order and some gold investors are even wondering if they should have invested in Nakamoto’s invention rather than the world’s oldest form of money.

Jitters are seriously beginning to show and yet the price keeps climbing. However high price does not necessarily equal validation. High price in this case is partly a sign of irrational exuberance. It is a sign of a market that is playing a short-game, blinkered by the mounting risks to which the bitcoin and cryptocurrency markets are exposed.

Bubblecious Bitcoin

Dr Constantin Gurdgiev, finance professor, respected market commentator and former non-executive adviser to GoldCore warned of a speculative bubble:

…at this point in time, bitcoin price can be potentially driven solely by expectations held by its enthusiasts, plus the incentives by the predominantly China-based investors to avoid extreme risks of capital controls and expropriations. If so, both drivers would make it a speculative bubble.

The problem with bitcoin is not that they are worth nothing. They are clearly worth something, if anything just because of the work that goes into creating them but also because there are people willing to make an economic exchange for them.

The problem with bitcoin is that while adoption is surging, it is still amongst a tiny section of the population – primarily the tech community and millennials. There are varied estimates but is believed that some 0.01% of the world’s population holds a bitcoin wallet (not even bitcoin as many have wallets and accounts but have not bought).

Leave A Comment