The price of Bitcoin made an impressive recovery, advancing from enjoying a bounce of over $400 and topping $6,500. Morgan Stanley is reportedly venturing into Bitcoin trading, responding to demand from clients. The report from Bloomberg on the topic may have been the trigger, but other reports suggest significant short-covering after a sharp sell-off beforehand.

Citigroup, another financial behemoth, is also showing interest in digital coins. Goldman Sachs vehemently denied new that it is abandoning its plans for a crypto trading desk. An ex-Goldman Sachs banker and ex-hedge fund manager, Mike Novogratz, said that Bitcoin has bottomed out. He is heavily involved in the blockchain world as a crypto fund manager.

The focus now turns to the next deadline for approving a Bitcoin Exchange Traded Fund (ETF). The Securities and Exchange Commission (SEC) has set September 21st as the new deadline for approving or disapproving five Bitcoin ETF’s. These are Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares.

The deadline for the Direxion requests precedes a September 30th deadline for other significant ETF contenders. ETF’s are critical for Bitcoin as they provide a gateway for mainstream traders and investors to enter the world of digital currencies. Speculation about ETF’s has been a crucial mover for crypto prices.

What’s next for Bitcoin?

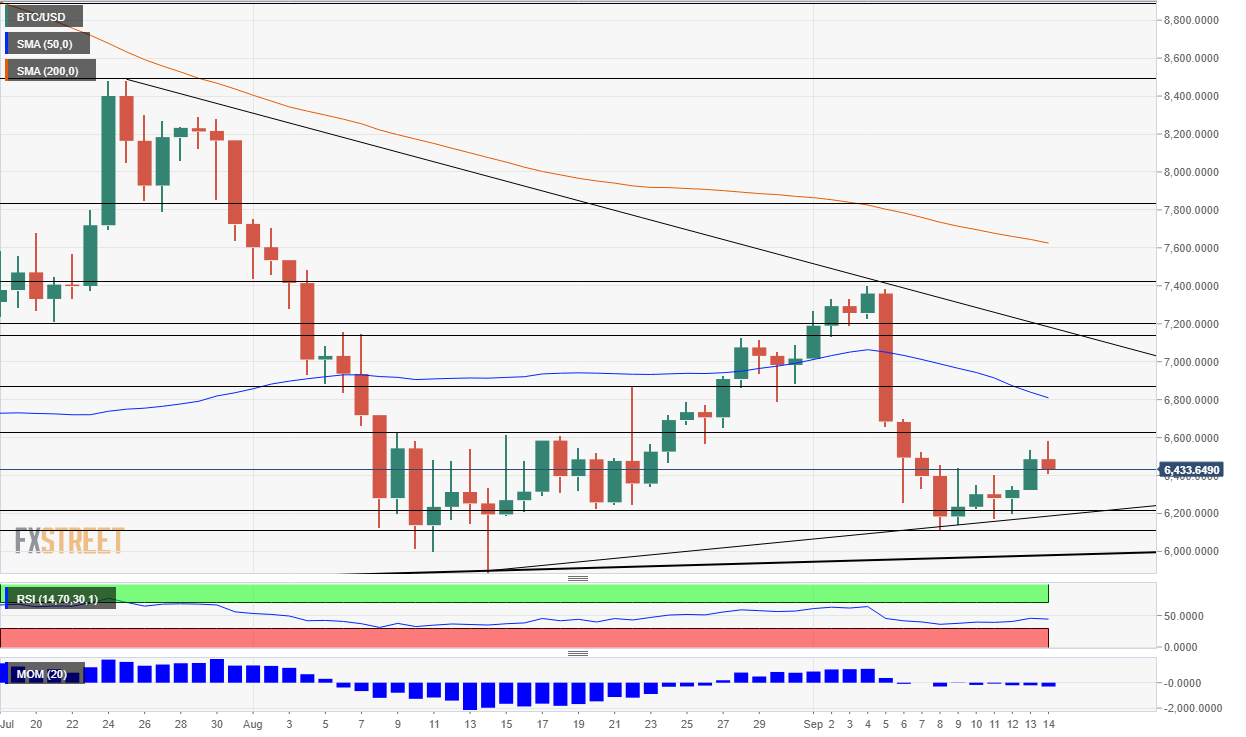

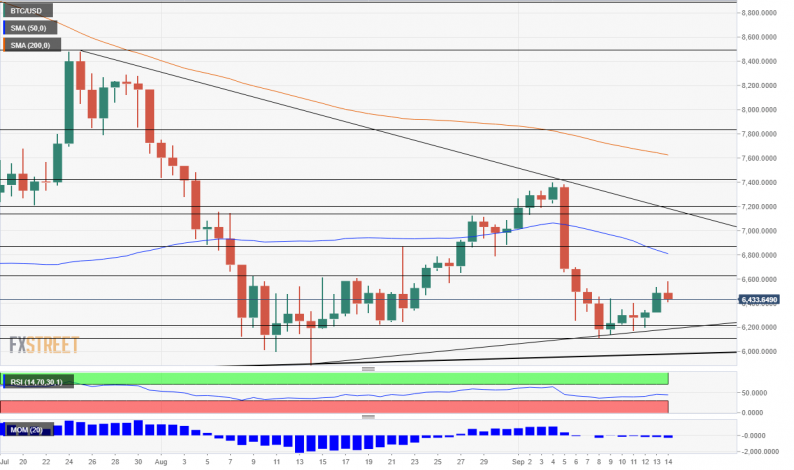

BTC/USD Technical Analysis – A few bullish signs

The recent downturn did not reach the lows below $6,000, and this is a bullish sign. However, other indicators are more nuanced. The BTC/USD is still trading below the 50 and 200 Simple Moving Averages. Momentum and the Relative Strength Index are not going anywhere fast.

Leave A Comment