Buy the crash. Sell the all-time high. Rinse. Repeat. This has been a time-honored trading strategy for Bitcoin that, in hindsight, has offered a very low-risk way of profiting form the manic rise of Bitcoin.

Today, the famed cryptocurrency was down as much as 30% before bouncing back with a furious rally. The trading strategy was in full display as Bitcoin rallied to close out the day with a “mere” 5.2%.

Trading volume apparently surged as Bitcoin hit its low of the day. Bitcoin was down as much as 30% on the day before bouncing.

Source: Yahoo Finance

At the lows of the day, Bitcoin (BTC) hit a 3-week low. The tremendous rally from there did not end the overall orderly decline from the last all-time high hit a week ago just under 20,000.

Bitcoin was the biggest story, but its troubles were shared by most of the over 100 cryptocurrencies now in existence. Coinbase crashed (again) alongside Bitcoin due to the massive traffic on its site as traders rushed to buy, sell, deposit, withdraw, and/or just watch the charts spin.

Source: Yahoo Finance

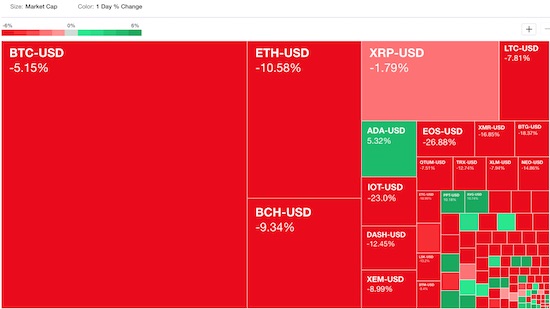

It was a rough day across the board for almost all 100+ cryptocurrencies.

I can only guess at what caused the massive panic, but I am duly noting that today was the last trading day before Christmas. Perhaps too many people had plans to try to secure their crypto funds into paper money ahead of the holiday. Whatever the reason, the end result after the dust settled was the on-going orderly decline from the all-time high set a week ago on December 15th.

As Bitcoin crashed, the headlines and articles churned out furiously. I particularly liked a piece from finance and CNBC veteran Ron Insana titled “The last person into a speculative frenzy such as bitcoin never gets out before it’s too late.” Insana told his own personal tale of flirting with jumping into the cryptocurrency frenzy and just barely missing getting in near the latest top. An over-eager friend was not so lucky. Full of hindsight, Insana of course regrets not getting in Bitcoin for $300 when he had a chance, but he also looks back with relief at how he avoided flushing his career into the dot-com bubble and bust at the turn of the 21st century.

Leave A Comment