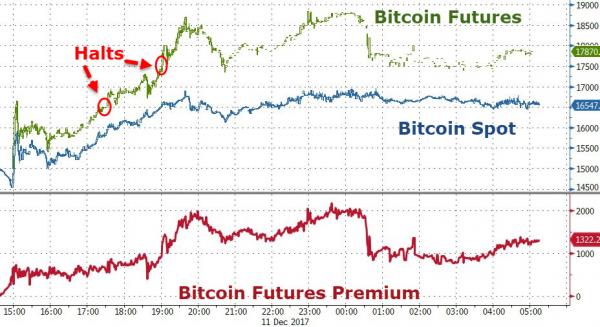

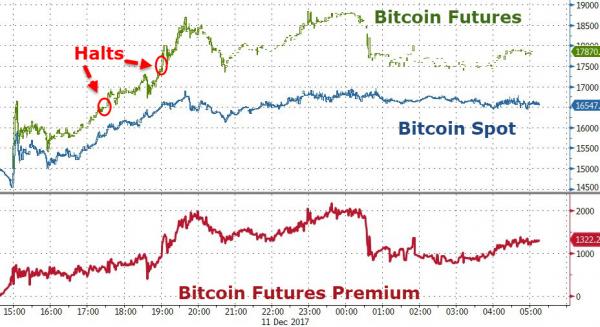

Despite broadly-spewed sentiment last week that Bitcoin futures would herald the end of Bitcoin as ‘shorts’ could finally capitalize on the ‘tulipmania’, for now, they have failed to turn up as the January-expiring futures are holding an 8% premium to spot prices and remain up around 19% from their opening print overnight.

Futures are holding around a $1000-$1300 premium to spot for the last few hours – implying quite a serious ‘term structure’ for Bitcoin credit.

Furthermore, instead of stabilizing Bitcoin as some had suggested, futures were actually more volatile than spot…

“It is rare that you see something more volatile than bitcoin, but we found it: bitcoin futures,” said Zennon Kapron,managing director of Shanghai-based consulting firm Kapronasia.

As Reuters reports, The roughly $1300 difference reflects not only the novelty of the asset but also the difficulty of using the cash-settled futures to trade against the spot, strategists said.

“In a normal, functioning market, good old arbitrage would settle this,” Ole Hansen, head of commodity strategy at Saxo Bank A/S in Hellerup, Denmark, said by email.

“If they were deliverable you could arbitrage the life out of it.”

Having crashed the CBOE website and been halted twice in its first 24 hours, it has been an exciting debut for sure, but not quite what the ‘experts’ Zennon Kapron,…

“The premiums have so far been very high, demonstrating that few want to take the short side of the trade,” said Altana Digital Currency Fund manager Alistair Milne, whose fund has $35 million in assets under management.

Volume remains de minimus for now – around 2,878 contracts traded so far (or around $50 million notional)…

That is around 2% of global Bitcoin trading volume since the open.

“We’re in the early stages here, and there’s not enough professional liquidity from the big market makers who can provide depth and hold in the movements,” said Stephen Innes, head of trading for Asia Pacific at Oanda Corp. “It’s going to be a learning curve.”

Leave A Comment