What’s the biggest ongoing bubble in markets?

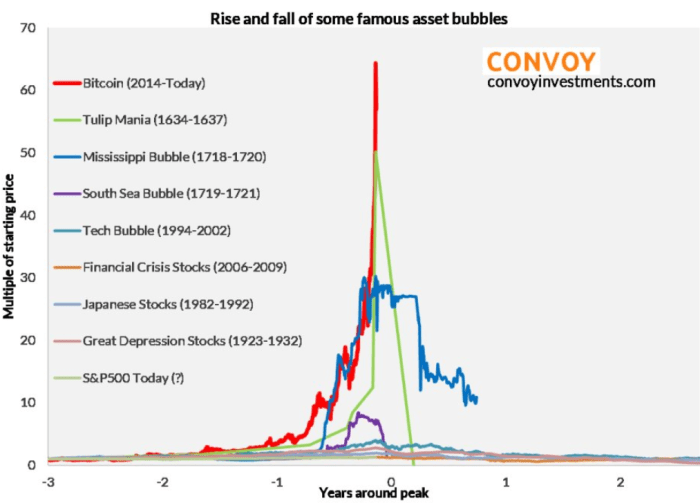

Obviously, the answer is Bitcoin. In fact, it appears to have surpassed the tulip mania this week, in the process laying claim to the rather dubious title of most egregious speculative bubble in the history of finance.

But as far as bubbles that are still inflating are concerned, the short vol. trade has at least some claim on the number 2 spot – even if it’s a distant second to anything related to the cryptoverse. Recall this from BofAML:

Stay with me here and recall the following from a recent note by Kevin Muir:

In 1992, the CBOE hired Robert Whaley to develop a tradable volatility product on equity index option prices. A year later, in 1993, the VIX was born when the CBOE started publishing real-time quotes on the implied volatility of the calculated S&P 500 index options. In those early days, I very much doubt Robert ever imagined his volatility index would someday be the cornerstone of some of the world’s most actively traded ETFs.

In fact, for the next decade, no VIX instruments traded at all, and it wasn’t until 2004 that the VIX future was listed. And then, it took another five years before the first ETF based on those futures hit the exchanges. But what a ride it’s been.

Think about all of the above and then consider the following chart:

For all the cat calls about a slow start to Bitcoin futures trading, Bloomberg’s Camila Russo suggests it’s been a veritable bonanza compared to VIX futures.

Referencing the numbers shown in the chart above (which reflect Bitcoin futures volume in the first two days since the launch for the January, March and February contracts versus volume in the first two days of trading for VIX futures in 2004 for the May, June, August and November contracts), Russo writes the following on Wednesday afternoon:

Leave A Comment