Bitcoin… For the vast majority of people, this original coin has long been synonymous with cryptocurrency.

Indeed, bitcoin was basically the only game in town until recently.

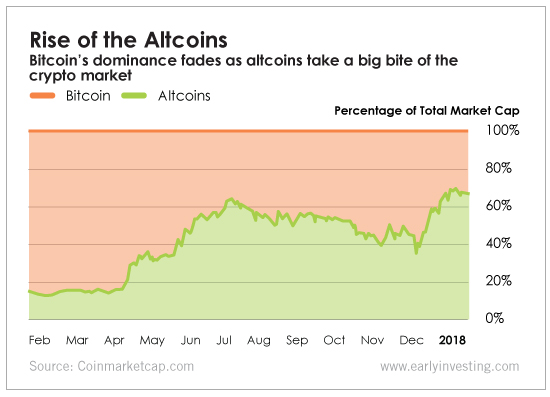

As you can see from the chart below, bitcoin accounted for roughly 85% of the crypto market one year ago.

Today, bitcoin makes up only 34% of the $500 billion-plus cryptocurrency market. New competitors such as Ethereum, Ripple, Dash, NEM, Monero and IOTA have emerged to grab big chunks of the market.

And hundreds of even smaller coins combine to make up around 25% of the market.

Collectively, everything that’s not bitcoin is referred to as the “altcoin” market.

While bitcoin has lost significant market share to altcoins, its value still skyrocketed from around $1,000 a year ago to around $11,000 today.

Over the same time period, altcoins have soared even higher than bitcoin, rising from just a few billion dollars combined to around $360 billion today.

In my view, these developments don’t represent the fall of bitcoin. We still need bitcoin as a reserve cryptocurrency, a secure rock in the crypto world. Instead, what we’re seeing is the rise of crypto as a new type of investment.

Crypto: A Maturing Asset Class

This past year has been a chaotic (and wildly profitable) one for crypto investors. And we’re beginning to see the type of market I envision as being necessary for crypto to grow into one of the largest global asset classes.

I’ve known for years that we need more than just a few big coins for crypto to thrive.

We need fierce competition among hundreds of coins, all of them using the power of open-source software to innovate and create amazing technology… and growing through the power of network effects and viral organic growth.

Today we’re seeing exactly that. There are now more than 30 separate coins with market capitalizations (total value) of more than $1 billion. Each has its own community of users, developers and supporters.

Leave A Comment