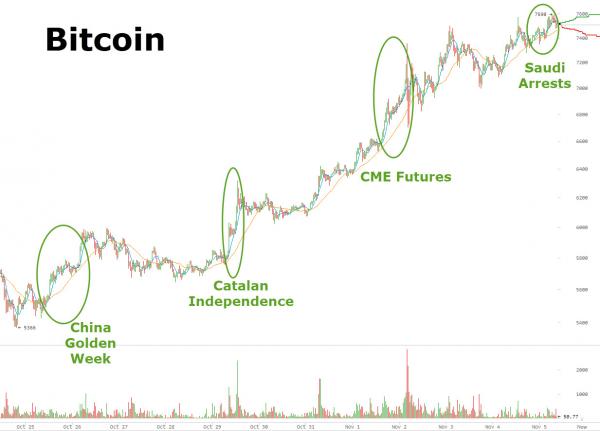

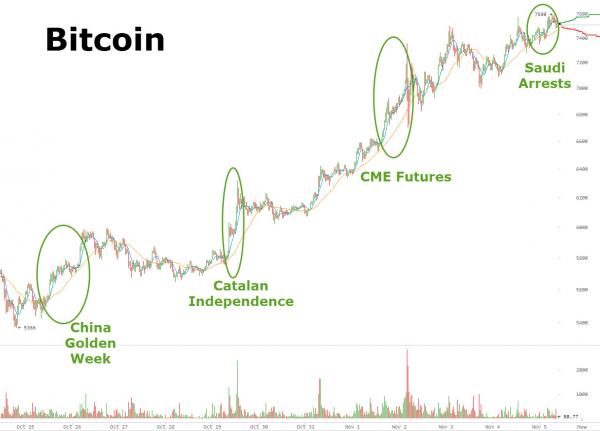

Another crisis in another nation and Bitcoin prices surge to another new high. Overnight chaos in Saudi Arabia has prompted Bitcoin to jump to $7590 – a new record high – ironically as Prince bin-Talal is arrested for money-laundering a week after calling Bitcoin “a fraud like Enron.” With a market cap over $125 billion, the cryptocurrency’s mysterious creator is now worth over $7 billion.

Oh the irony.

A week ago Saudi prince Alwaleed bin-Talal made headlines around the world proclaiming that:

I just don’t believe in this bitcoin thing. I think it’s just going to implode one day. I think this is Enron in the making.”

“It just doesn’t make sense. This thing is not regulated, it’s not under control, it’s not under the supervision” of any central bank.

And now, a week later he is arrested on money-laundering charges and has had his bank accounts frozen… which would not have been a problem if he had some of his wealth in cryptocurrencies.

The uncertainty surrounding the Saudi king’s moves prompted a further bid in Bitcoin to new highs (after a week of headlines pushed the crypto currency higher).

This pushes Bitcoin’s market cap to $125 billion – on par with Nvidia – who produce so many of the rigs used for mining the cryptocurrency.

As a result, Yahoo reports that one of Bitcoin’s largest holders appears to now be worth over $7 billion.

In 2013, Bitcoin watcher and head of cryptocurrency firm rsk.co Sergio Lerner wrote a series of blog posts explaining why he believes an account holding 980,000 individual Bitcoins belongs to Bitcoin’s mysterious founder, Satoshi Nakamoto.

Lerner analyzed the path of the first Bitcoins ever created, or “mined,” and traced them to a single mining source. Lerner then correlated this source to about 19,600 other Bitcoin “blocks,” which were actually just sets of cryptographic puzzles that, when solved, were worth 50 Bitcoins in 2010.

Leave A Comment