Bitcoin has surged to a new record high this morning over $4850 amid increased debt ceiling anxiety, continuing demand from South Korea and Japan amid the North Korea chaos, a potential short squeeze, and renewed hopes of SEC approval of a Bitcoin ETF.

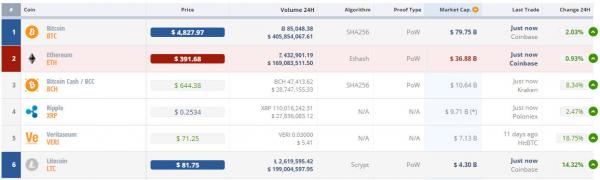

The six biggest virtual currencies are all higher today.

NOTE – Litecoin and Veritaseum are among the day’s best performers.

Bitcoin is now up 165% from pre-Fork-anxiety lows in late July.

Bloomberg’s Eric Balchunas notes that Dalia Blass is set to head the SEC Division of Investment Management – which regulates, among other things ETFs. What is of note is that she is a lawyer at Ropes & Gray – the same form representing the Winklevoss twins Bitcoin ETF case. This has prompted excitement that a ‘proper’ (not GBTC, see below),Bitcoin ETF may be sooner than expected.

As CoinTelegraph reports, the SEC famously rejected two Bitcoin ETF proposals earlier this year, citing largely unregulated markets. They did leave themselves an out, however. The Commission indicated that in the event that a regulated futures market for Bitcoin were developed, they might reconsider. Not long ago, the Commodity Futures Trading Commission (CFTC) gave LedgerX permission to create such a futures market. The SEC agreed to hear an appeal from the Winklevoss twins earlier this year, but few watchers expected the twins to receive a different answer.

With Blass at the helm and regulated futures markets being developed, however, this could change.

Some have argued that the recent rise in the price of cryptocurrencies is driven by anxiety over the debt ceiling in the US.

And also of note, as Alistar Milne notes, there are now more open short Bitcoin positions than longs on Bitfinex, potentially causing a short squeeze.

Finally we note that not everyone is buying into Bitcoin.

First, GBTC (Bitcoin Investment Trust) – which we have discussed numerous times (here and here most recently) – made some headlines overnight as it topped $1000 (implying a $10,000 price for Bitcoin) and Citron’s Andrew Left went on CNBC and explained why he was short.

Leave A Comment