What if Bitcoin is a reflection of trust in the future value of fiat currencies?

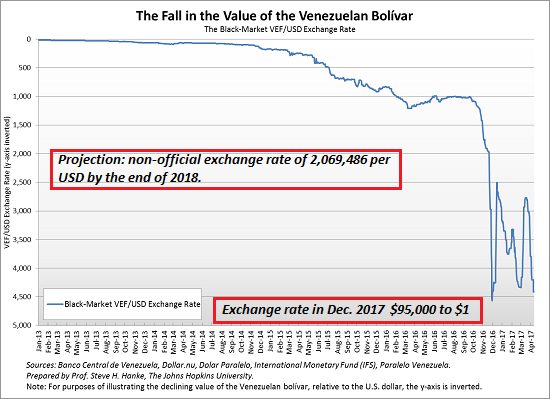

I am struck by the mainstream confidence that Bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela’s fiat currency, which has declined from 10 to the US dollar in 2012 to 5,000 to the USD earlier this year to a current value in December 2017 of between 90,000 and 100,000 to $1:

Exchange Rate in Venezuela:

On 1 December, the bolivar traded in the parallel market at 103,024 VED per USD, a stunning 59.9% depreciation from the same day last month.

Analysts participating in the LatinFocus Consensus Forecast expect the parallel dollar to remain under severe pressure next year. They project a non-official exchange rate of 2,069,486 VEF per USD by the end of 2018. In 2019, the panel sees the non-official exchange rate trading at 2,725,000 VEF per USD.

If this is your idea of rock solid, I’ll take my chances with bitcoin, which currently buys more than 1 billion bolivars. Of course “it can’t happen here,” which is precisely what the good people of Venezuela thought a decade ago.

Gordon Long and I discuss Fiat Currency Failure (The Results of Financialization – Part IV) in a new 31-minute video. The bottom line is that fiat currencies are debt-based claims on future profits, energy production and wages, claims that are expanding far faster than the real economy and the productivity of the real economy.

In effect, fiat currencies and debt are like inverted pyramids resting on a small base of actual collateral.

If you look at the foundations of fiat currencies, you find loose sand, not bedrock. Massive mountains of phantom wealth have been created by central-bank inflated bubbles, bubbles based not on the actual expansion of net income earned from producing goods and services, but on financialization, the pyramiding of debt and leverage on a small base of real assets.

Leave A Comment