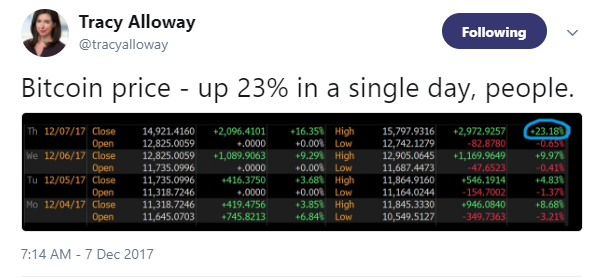

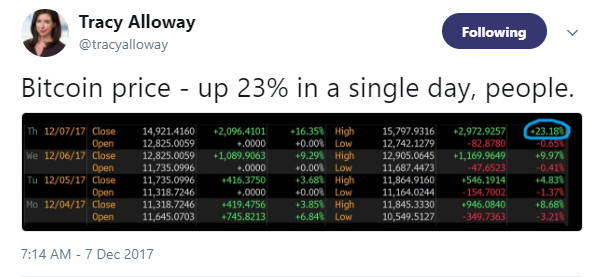

Every time the furry over Bitcoin appears to have reached a crescendo, it only explodes higher. This can not only be seen in the price – up 23% in a single day. But is can also be seen in the ratcheting up in the profile of those getting involved in the debate, with none other than former Fed Chair Alan Greenspan the latest to opine. But when the issue is considered from the standpoint of Bitcoin vs gold, the dramatic price rise might not seem so improbable, as both assets have very little practical value.

Bitcoin vs gold: Its about to get real as banks start fighting bitcoin futures launch

You know the battle over Bitcoin is intensifying when the big banks start to crank up their interminable lobbying machine to halt the advance. The Financial Times reported early Thursday morning that “the world’s largest banks are pushing back on the introduction of bitcoin futures.”

Citing the Futures Industry Association, “whose members include all the largest Wall Street banks,” the article pointed to a letter that is destined to arrive in Commodity Futures Trading Commission hands Thursday stating opposition to the December launch of futures contracts on the CME and CBOE exchanges. The letter cites a lack of transparency in the approval process, improper deliberation methods and increased systemic risk.

“It is also our understanding that not all risk committees of the relevant exchanges were consulted before the certification to launch these products,” the letter stated, pointing to a self-certified regime for “these novel products” that add risk to the listed derivatives clearinghouse structure.

An oft concern is that with such dramatic price swings, margin calls could flood the system during a price crash, exacerbating the market slide. Because the underlying derivatives industry clearinghouse structure is based on mutual risk sharing to a degree, there are extreme scenarios under which a margin catastrophe could put “legitimate” futures contracts used for managing risk in agricultural and financial products at risk.

Leave A Comment