This episode happened back in the days before cell phones, and that’s what made it all the more unnerving. Your editor was speaking to an audience of nearly 1,000 investors at a Salomon Brothers conference (our then employer) in Boca Raton on the morning of October 19, 1987.

At first, a few people got up from their chairs and walked out, which we thought was quite rude because we had not even gotten to the truly offensive part of our speech!

Then, the auditorium began to buzz noticeably—so we ramped up the volume and speed of our delivery.

At length, half the room was gone and not wishing further humiliation, we finished up quickly and sat down. What remained of the audience then stampeded for the exits.

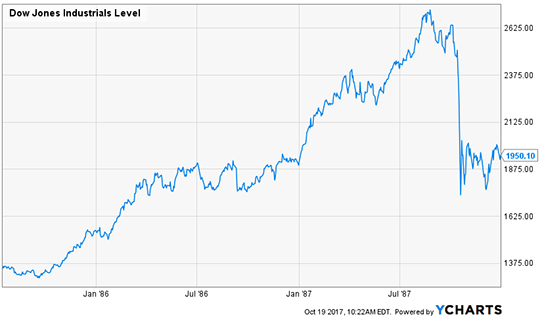

Soon enough we learned that the stock market was plunging toward its eventual 508 Dow point crash or 22.6% decline. In today’s world that would be 5,200 points on the Dow. In one day!

We happened to mention this episode during an appearance on Fox Business this morning (video below) and the hosts rose up in a mighty chorus insisting we were talking ancient history and that “it’s a totally different world today”.

On that much we could agree, but not in a good way!

So our ruminations today are on how the big picture has changed for the worse, and why the boys and girls and robo-machines still in the casino and still chasing the dip do not see Black Monday 2.0 coming down the pike.

The spoiler alert is that the era of Bubble Finance started the day after the 1987 crash when Greenspan opened up the monetary spigots; and it ended 30 years later in October 2017. That’s when the mad money printers at the Fed finally realized they had used up all their dry powder and belatedly launched a new era of balance sheet shrinkage and QT (quantitative tightening), which will drain trillions of cash from the financial system in the years ahead.

It would be more than fair to label these two October developments—separated by three decades—as monetary book-ends.

Before Black Monday in October 1987, the Fed’s balance sheet had grown only sparingly, more or less in pace with nominal GDP. Indeed, during the first 73 years after opening for business in 1914, the Fed’s balance sheet had resembled the classic Ohio State offense: To wit, three yards forward and a cloud of dust, year after year. By October 1987 it stood at just $200 billion.

But after Greenspan succumbed to total panic on Black Monday—and for political reasons, not economics (see below)—- the world changed dramatically. The Fed’s balance sheet is now 22X larger at $4.4 trillion, and that massive growth of fiat credit has fueled the greatest inflation of financial assets in recorded history.

As shown in the chart below, especially since the great financial crisis of 2008, the Fed’s growth rate has bordered on sheer lunacy. At 25% per annum, credit conjured from thin air has been pumped into the canyons of Wall Street at a rate 7-10 times faster than the real growth capacity of the main street economy.

Leave A Comment