Things are going from bad to worse for the efficacy of the grand – and failed from the beginning – experiment known as Abenomics. As Bloomberg reports, Larry Fink’s Blackrock has changed its stance on investing in Japan, and joins Citigroup, Credit Suisse, and LGT Capital Partners, the $50 billion asset manager based in Switzerland in their decision to head for the exits.

Ironically, Blackrock’s decision comes only a few months after blogging about “The Case for Investing in Japan”, in which they explicitly cited increased demand for Japanese stocks.

INCREASED DEMAND FOR JAPANESE STOCKS

The BOJ and other large institutions have increased their investments in Japanese equities. Meanwhile, the recent successful Japan Post initial public offering has renewed domestic interest in equities and likely increased demand for Japanese equities by investors around the globe.

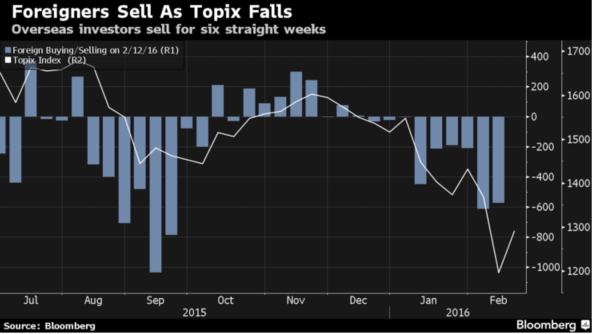

This is the latest in a long list of setbacks for Japan in their quest to inflate consumer prices and their stock market. Foreign investors have been getting out of the market all year long, as concerns about the global economy and a strengthening yen continue to be at the forefront. So far they’ve dumped $46 billion in shares according to reports.

Meanwhile, Japan is doing all it can (according to the Abenomics playbook). NIRP, Japan’s latest central bank tool form the proverbial “toolbox” has been fully implemented, with a negative 10Y bond auctioned just last month. So far it is not enough.

It has also apparently done enough damage on the fixed income side to sway the worlds biggest state investor, their very own Government Pension Investment Fund, to move more into equities. However with other major players not wanting to be invested in Japan, the BoJ may very well have to increase their ETF holdings to roughly 100%.

But most entertaining would be Peter Panic’s reaction. A photographer’s s rendering of Kuroda’s face upon hearing that even his most devoted supporters are now giving up on him would probably look like the change from this…

Leave A Comment