Ok, well it wouldn’t be entirely inaccurate to say that things fell apart in China overnight.

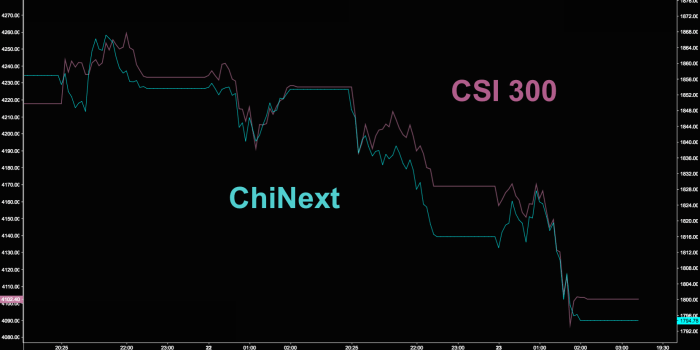

Just two days after surging nearly the most in three months, the CSI 300 fell the most since June of last year and the ChiNext plummeted 3% as well:

That’s the lowest close since August 25 from the ChiNext:

The SHCOMP wasn’t much better, falling 2.3%:

Part of the problem here is obviously the fear that Beijing’s push to rein in the shadow banking complex will end up choking off liquidity and exacerbating a bond selloff. They’ve been battling to keep 10Y yields below 4% this month and that’s a battle they’re just barely winning:

10-year government bond yields fell on Thursday after jumping 4 basis points in the previous session. Notably, the yield on similar-maturity China Development Bank bonds dipped 2bps. Policy bank yields have come under increased scrutiny this week after the spread between yields on China Development Bank’s April 2027s and 10Y government bond yields exploded 11bps on Wednesday, the most since December 2014. Those 2027s are yielding 5.02% – so that’s a quasi-sovereign yielding more than 5% for the first time in at least three years.

The PBoC injected 100b yuan today bringing this week’s total to 130b yuan – that’s an effort to allay liquidity concerns and it underscores the precarious nature of the tightrope walk.

“The bond yield is rising too fast and triggered worries in the market, reflecting how tight the liquidity supply is [so] investors rushed from bonds, triggering the rise in yields, which are negative for corporate profits as their financing costs will increase,” Castor Pang, head of research at Core-Pacific Yamaichi HK said, adding that this is “very bad news for the stock market [as] the impact of such a rapid bond yield increase is similar to that of an interest rate hike.”

In addition to the bond market jitters, people are apparently also worried about sorghum liquor maker Kweichow Moutai, which is the second-largest stock on the SSE 50. Xinhua News cautioned about the stock’s valuation on November 16 and it’s been a veritable bloodbath since:

Leave A Comment