Bloomberg appeared to begrudgingly deliver a half-assed story on copper Wednesday. This sad reporting misses all the key elements. Even I, Russ Winter, sitting in my bathrobe and slippers, was able to break the real story in last week’s “Subscriber Notes.” It’s not rocket science:

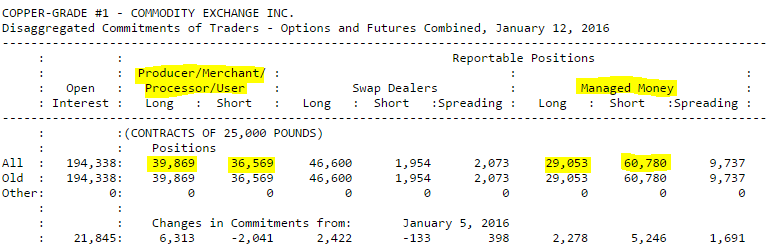

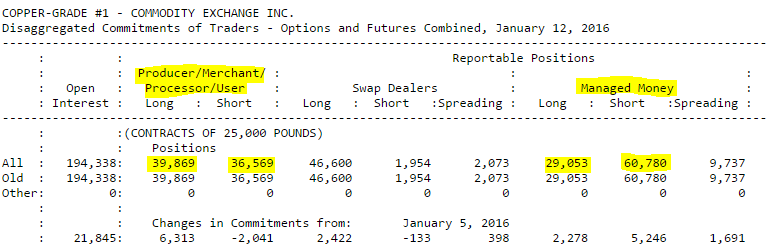

The Commitment of Traders in copper is astonishing. The swap dealers have almost no shorts, and the producers and processors are net long. Wow! This one might be what takes down the Comex synthetic market.

Now, what Bloomberg fails to report is who exactly has cornered the long side of the LME copper market. A real reporter and a real business network might sleuth under the layers of fronts and companies to name names and peal back the onion. Who is preventing this reporter from picking up the damned phone for heaven sake? Is it agents for China, who almost unnoticed announced a 150,000-ton copper stockpiling plan, which I also duly reported in “Subscriber Notes.” Is it a Crime Syndicate operative? Some long overdue white hat who has had enough of synthetic paper skulduggery?

I don’t have the resources and access of these “business reporters,” but even I can reference observers to the other synthetic paper so-called market, namely the Comex. You will see it above under “Swap Dealers” and it’s a position that’s one for the ages: 46,600 contracts long and a mere 1,954 short. Gee, do ya think some bankster or someone a bankster is fronting for has the long position? Hmm.

They might ask who is short. Is it Satan, LLC? No, instead we get vagueness. But we can see the answer in the Comex report under: managed money.

In addition, Bloomberg plays down this story, making it about the cost of carrying a short position. Why aren’t they pointing out the real reason “someone” is long cornering the synthetic copper market? There are very low inventories of real copper around, and about a fourth of the world’s production is money-losing. And it’s even worse on the production curve for zinc (69 c/per lb, 30% money-losing) and nickel ($3.92/per lb, 60% money-losing).

Leave A Comment