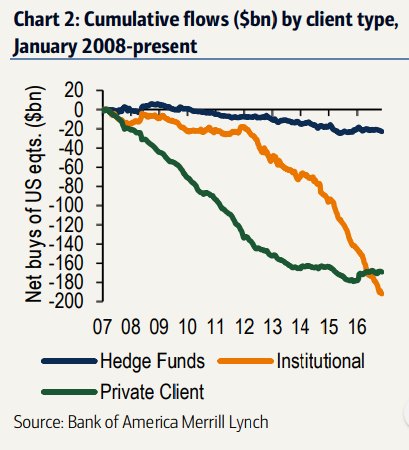

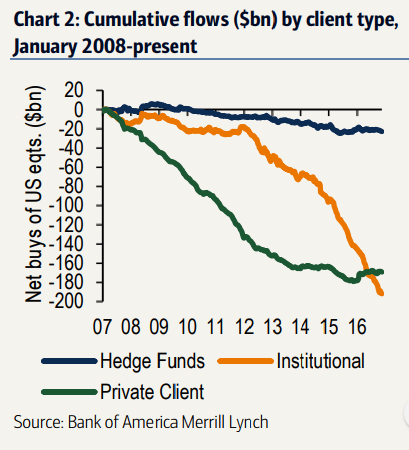

For the past nine years, private investors have avoided stocks. According to Bank of America’s weekly client asset flow trends report, in every year since 2008, private clients have sold equities on a net basis. The only year to buck this trend was in 2015 when clients acquired a net $1.8 billion in stocks including ETF flows. Excluding ETFs, outflows came in at $30 billion.

It now looks as if this trend has gone into reverse. For the first time since the financial crisis, private investors are now buying equities in size, according to BoA’s figures. The latest issue of the bank’s equity flow trends report shows a net inflow of nearly $9 billion year-to-date, compared to last year’s net outflow of $14 billion. As the chart below shows, this recovery has been enough to stem the bleeding, for the time being at least.

Private investors buy as institutions sell

Even though private clients have been buyers for the year as a whole, for the week to November 17, all BoA sold US equities for the third straight week. Hedge funds, institutional clients, and private clients were all net sellers for the eleventh, third, and second consecutive weeks, respectively.

Even though the overall trend was selling, some assets saw buying, mainly from institutional investors. ETFs proved to be especially popular with institutions with ETF purchases near record levels (sixth highest recorded since 2008).

“Clients bought both Growth and Value ETFs, following two weeks of Growth ETF net sales, and bought ETFs across all sectors except Health Care, Utilities, and Materials. Tech ETFs continue to have the longest buying streak (13 straight weeks), with buying from all three client groups last week despite big single stock sales in this sector.“

On the corporate front, buybacks from corporate clients slowed to a five-week low. Year-to-date, cumulative buybacks are tracking in line with last year’s levels but below 2014/15 highs.

Leave A Comment