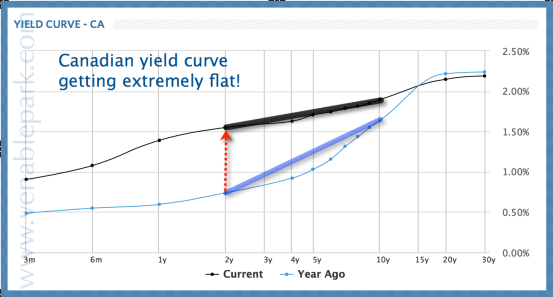

Bank of Canada sat tight today–no rate hike–seeing economy weakening into 2018.With the 10 to 2 year Canadian government yield spread now .36% versus .75 a year ago (red arrow), the bond market also sees slow growth looking into the new year.

A few charts from The 91 Most important economic charts to watch in 2018 sums Canada’s headwinds well here.The first one is Credit (household and business) to Gross Domestic Product Gap now at a 45 year high, as shown here. Ted Carmichael, explains his chart this

way:

“Previous peaks preceded or coincided with economic recessions in 1981-82, 1990-91, and 2008-09… According to the BIS, countries with Credit Gaps of greater than 10 per cent of GDP are at risk of a financial crisis. Only China, Hong Kong, Singapore and Canada currently have Credit Gaps exceeding 10 per cent. Large credit gaps usually result from extended periods of low interest rates and/or lax borrowing standards. Canada’s gap of 17.8 per cent is considerably higher than the 12.4 per cent that the U.S. credit gap reached in the first quarter of 2008, just at the onset of the Global Financial Crisis.”

And unfortunately, Canada’s record indebtedness is not from productive investment that revamped our infrastructure or business sector to boost future productivity. As shown here, Canada’s business investment as a share of GDP has actually been one of the lowest of the OECD countries.

No, Canadian households and businesses have levered themselves to record highs this cycle, not to make smart investments for the future, but rather to buy things that depreciate like cars and discretionary goods, as well as over-valued real estate and corporate shares (that are also likely to depreciate from present levels).

All while our aging demographics are set up to detract from growth and revenue over the next 20 years as shown below.This will make paying back what’s already been borrowed, that much harder and take that much longer.

Leave A Comment