The Bank of England has done some timely and truly eye-opening research into the resilience of corporate bond markets. The research is contained in the Bank of England Financial Stability Paper No.42 and is titled “Simulating stress across the financial system: the resilience of corporate bond markets and the role of investment funds” by Yuliya Baranova, Jamie Coen, Pippa Lowe, Joseph Noss and Laura Silvestri.

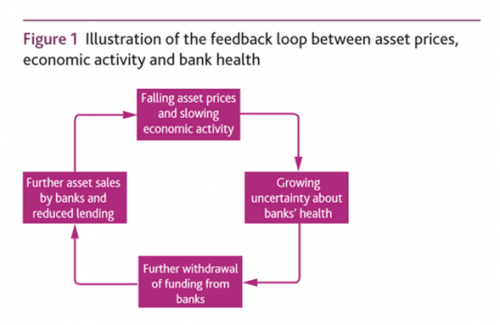

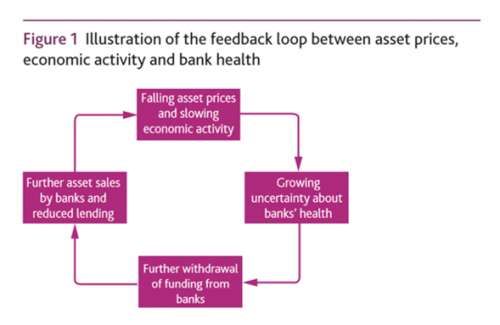

The starting point of the analysis is to revisit the Global Financial Crisis (GFC) which saw $300 billion of related to subprime mortgages amplified to well over $2.5 trillion of write-downs across the global financial system as a whole. One of the problems was that the system was structured in a way that did not absorb economic shocks, but amplified them. The amplification came via a feedback loop. As the crisis unfolded, fears about credit worthiness of banks led to the collapse of interbank lending. Weaker banks had their funding withdrawn, which led to a downward spiral of asset sales and the strangling of credit in the broader economy.

The paper notes that, since then progress has been made and the Bank of England’s stress tests now include the feedback loop created by interbank loans.

Indeed, the 2016 test showed that the potential for solvency problems to spread between UK banks through this channel has “fallen dramatically” since the crisis. Furthermore, interbank lending has been cut back and is more often secured against collateral.

The report cautions that other feedback loops might be present, especially since banks only account for about half of the UK financial system. Indeed, a key objective for regulators is to assess how the non-bank part of the system – termed “market-based finance” in the paper, responds to economic shocks. In particular, could the non-bank system, which trades “market-based finance” (principally bonds), amplify shocks in a similar way to the banking system during the last crisis? The report characterizes market-based finance and the related risks as follows.

Leave A Comment