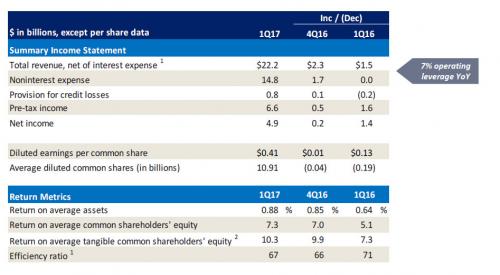

Following conflicting earnings reports by JPM, Citi and Wells, Bank of America reported a jump in its quarterly profit, announcing EPS of $0.41, above the expected $0.35, as net income rose 40% Y/Y to $4.86 billion, up from $3.47 billion a year ago. Revenue was $22.25 billion, up from $20.79 billion a year ago, with adjusted revenue printing at $22.45 billion compared, beating estimates of $21.61 billion.

The rebound in Q1 profits was led by Global Banking and Global Markets, with Consumer Banking also posting a modest rebound.

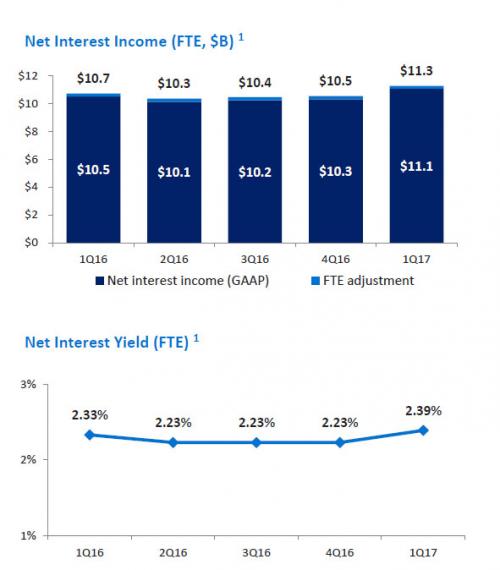

A key driver for the strong performance in Q1 was the apparent rebound in the bank’s Net Interest Margin, which rose from 2.23% to 2.39%, the highest in over a year, which in turn sent Net Interest Income sharply higher by $800 million to $11.3 billion. According to BofA, net interest income of $11.1B ($11.3B FTE); increased $729MM (FTE basis) from 4Q16, “reflecting the benefits from higher interest rates, a decline in market-related hedge ineffectiveness, seasonal leasing benefits as well as loan growth, partially offset by two fewer interest accrual days.”

BofA expects NII to increase in 2Q17, assuming rates remain at current levels and modest growth in loans and deposits.

We remain positioned for NII to benefit as rates move higher: +100bps parallel shift in interest rate yield curve is estimated to benefit NII by $3.3B over the next 12 months, with nearly 75% of the benefit driven by short-end rates.

Also boosting Q1 revenue was stronger performance by the bank’s Global Markets group, which saw FICC trading rev. excl DVA $2.93BN, higher than the est. $2.58BN. Equities trading rev. excl DVA $1.10b, also higher than the $1.01BN estimate.

Revenue, excluding net DVA, increased 27% from 1Q16 3, driven primarily by improved sales and trading results and higher capital markets fees

Sales and trading revenue of $3.9B, up 13% from 1Q16: FICC up 17% to $2.8B and Equities up 5% to $1.1B

Leave A Comment